Simplified, Secure & Compliant Trust Accounting Software

LeanLaw’s intuitive, cloud-based trust accounting system powered by QuickBooks Online helps your law firm:

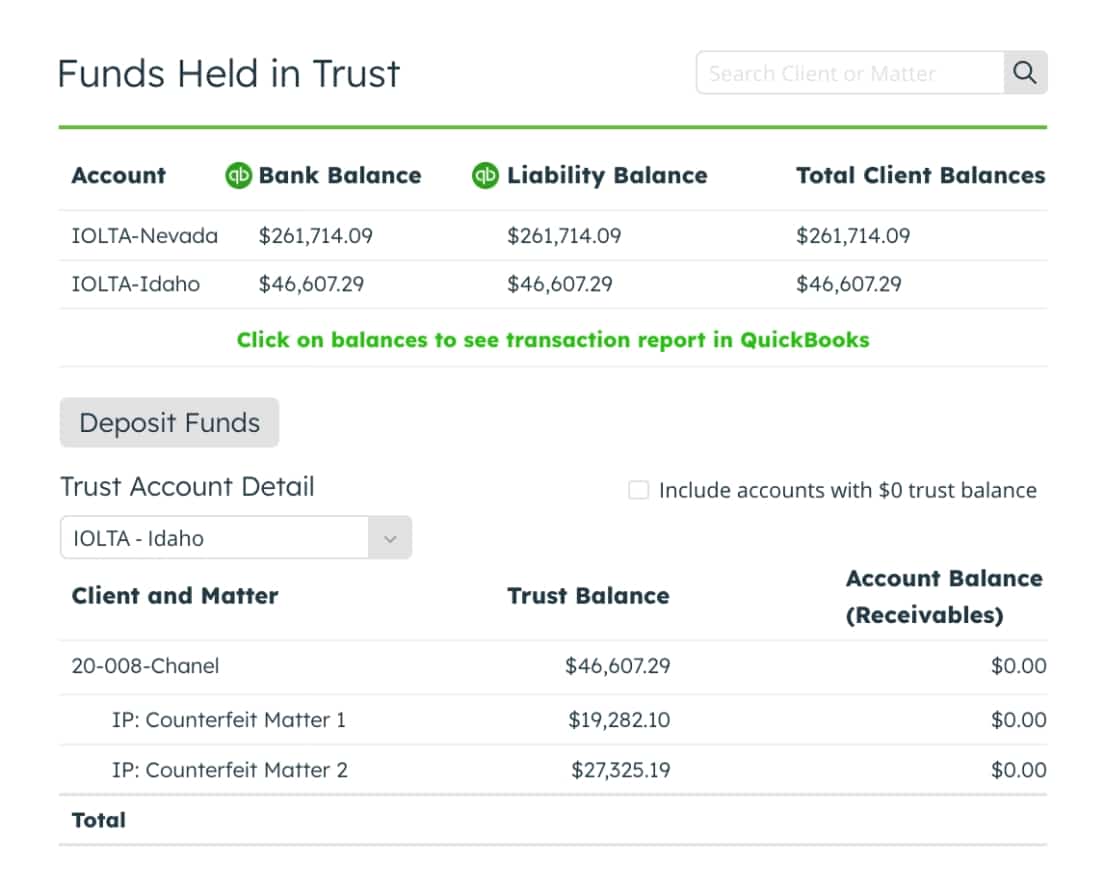

- Effortlessly maintain compliance with bar regulations and industry best practices

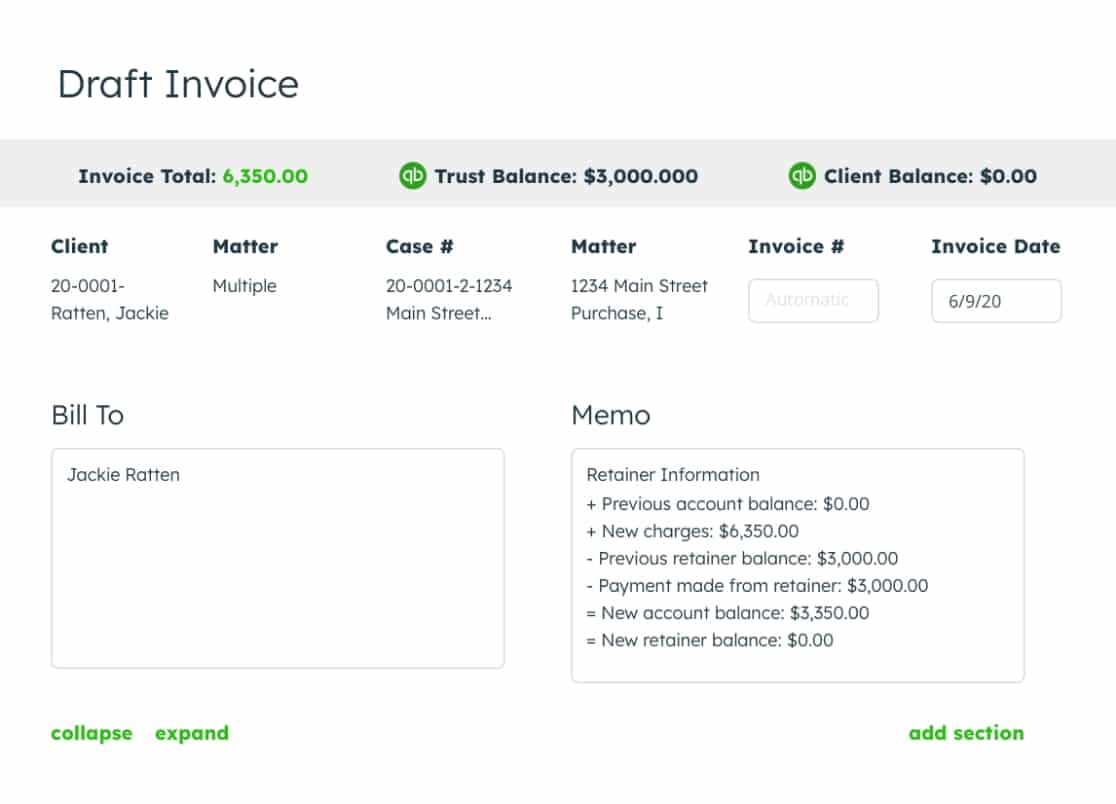

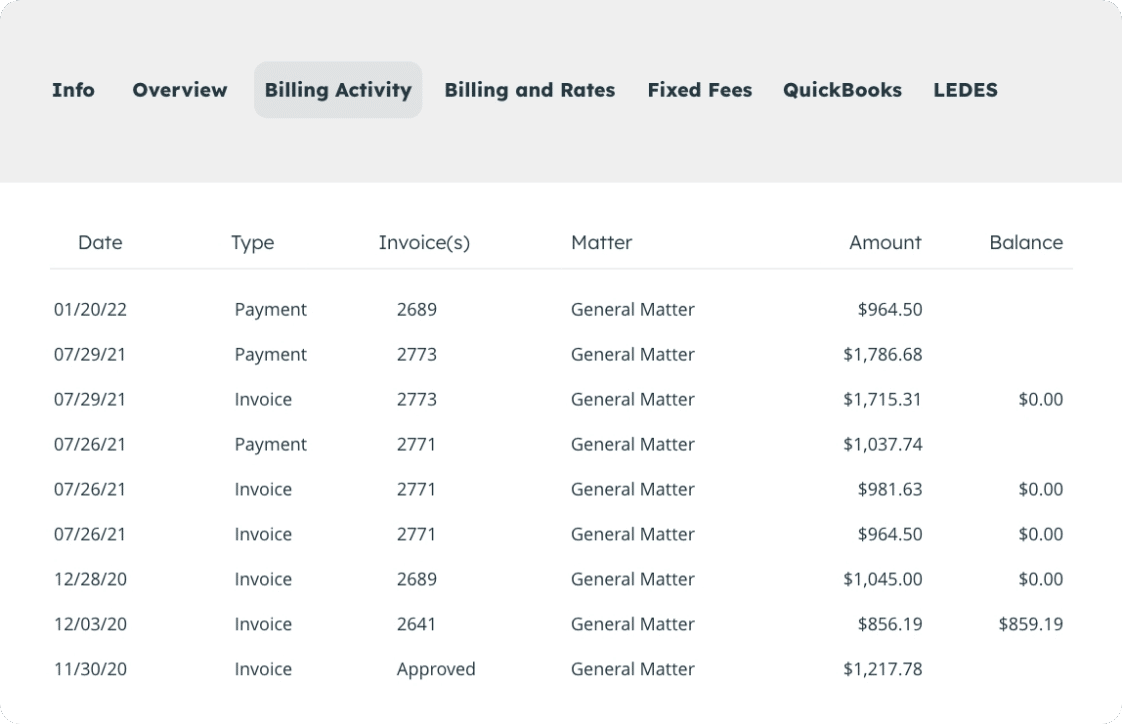

- Automate your client fund management to save time and reduce errors

- Accelerate cash flow and minimize accounts receivable

With continuous real-time syncing and three-way reconciliation, LeanLaw keeps your trust accounts audit-ready 24/7.

Put Your Trust Accounting on Autopilot.