Managing client trust accounts isn’t just an administrative headache – it’s an ethical lifeline for your law firm. In Texas, proper trust accounting can make or break your practice. One of the top reasons lawyers face discipline or even disbarment is mishandling client funds in trust. Don’t become part of that statistic! At the same time, mastering trust accounting can greatly benefit your firm’s financial health. When done right, it ensures you get paid for your work on time – no more chasing down invoices, since client fees held in trust are collected 100% of the time once earned. In short, trust accounting is both a serious responsibility and a smart business strategy for Texas law firms.

This guide will walk you through the essentials of trust accounting for small and mid-sized firms in Texas. We’ll cover why it’s so important, the Texas-specific rules you must follow, common mistakes (and how to avoid them), best practices to keep you compliant, and how legal tech (like LeanLaw’s trust accounting software) can simplify the whole process. Our aim is to provide you with practical, actionable insights – in plain English – so you can protect your clients’ funds and your firm’s reputation.

Why Trust Accounting Is Crucial for Texas Law Firms

Trust accounting isn’t just an administrative task mandated by the State Bar – it’s fundamental to the integrity of your practice. Texas attorneys have a fiduciary duty to safeguard client money. Mishandling trust funds can lead to severe consequences, including loss of your law license. In fact, the Texas Bar notes that lawyers “frequently come into the disciplinary system for trust account errors”. Clearly, nothing will get a lawyer in hot water faster than playing fast and loose with client trust accounts.

On the flip side, diligent trust accounting offers real benefits. With client funds in a trust account (often in the form of retainers or advance fee deposits), you have guaranteed cash flow for your fees once earned. No more waiting on clients to pay – you simply transfer earned fees from the trust to your operating account after invoicing. This means healthier accounts receivable and fewer collections headaches for your firm. Proper trust management also builds client trust (no pun intended). Your clients can see that their money is handled transparently and responsibly, reinforcing your professionalism.

Finally, trust accounts in Texas serve a broader purpose beyond your firm. Texas operates an Interest on Lawyers’ Trust Accounts (IOLTA) program that pools interest from client trust accounts to fund legal aid. (In Texas, the Texas Access to Justice Foundation administers IOLTA to support services for underrepresented communities.) By diligently managing an IOLTA, your firm contributes to access to justice while staying on the right side of ethical rules. In sum, trust accounting is critical not only to avoid disciplinary action and maintain your good standing, but also to ensure financial stability and uphold the legal profession’s ideals.

Texas Trust Accounting Rules and Compliance Requirements

Every state has strict rules for handling client funds, and Texas is no exception. The cornerstone is Rule 1.14 of the Texas Disciplinary Rules of Professional Conduct, aptly titled “Safekeeping Property.” In plain terms, Rule 1.14 requires that client funds must be kept separate from the lawyer’s own funds. This means no commingling – you cannot deposit client money in your personal or firm operating account. Instead, you must use a designated trust account (often titled “Trust Account” or “Escrow Account” at the bank) for any funds belonging to clients or third parties.

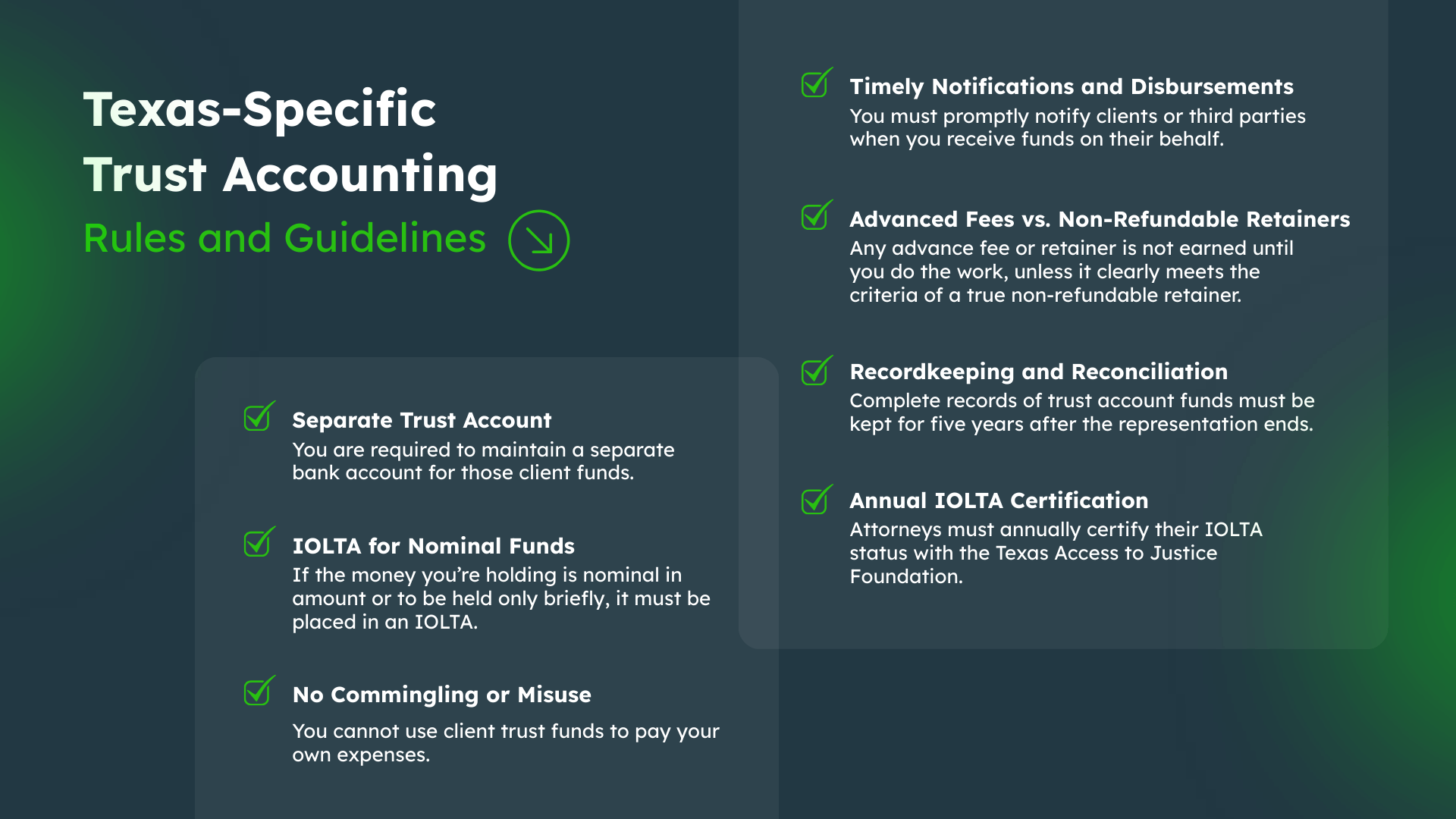

Here are key Texas-specific trust accounting rules and guidelines to know:

Separate Trust Account

If you’re a Texas attorney in private practice and you handle client money, you are required to maintain a separate bank account for those client funds. This account should be in a Texas financial institution and clearly identified as a client trust or escrow account. Only client or third-party funds related to representation go into this account – never your firm’s funds (except perhaps a small amount to cover bank fees if allowed).

IOLTA for Nominal Funds

Texas, like most states, uses IOLTA accounts for small or short-term client funds. If the money you’re holding is nominal in amount or to be held only briefly, it must be placed in an IOLTA – an interest-bearing trust account where interest is pooled for the Texas Access to Justice Foundation . Larger amounts held for longer periods may be put in a separate interest-bearing account for that client’s benefit, but for typical retainers and advances, IOLTA is the norm. Texas has a mandatory IOLTA program, so attorneys cannot simply hold client money in non-interest accounts or elsewhere; you either use IOLTA or set up an individual interest-bearing account when appropriate.

No Commingling or Misuse

You cannot use client trust funds to pay your own expenses – even “borrowing” from a trust account for a short time is strictly forbidden. Under no circumstances should any funds leave the trust account except to go to their rightful owner or to pay an expense on the client’s behalf. For example, you cannot withdraw money to cover your firm’s bills with a plan to “reimburse it later.” Even a small, well-intentioned misuse is a serious violation that can lead to fines or disbarment. The trust account is sacrosanct – treat those dollars as client property at all times.

Timely Notifications and Disbursements

Texas rules also say you must promptly notify clients or third parties when you receive funds on their behalf and deliver funds to them or on their behalf promptly when due. For instance, if you receive a settlement check, you should inform the client and deposit it into trust. Once funds clear and any conditions (like paying medical liens) are satisfied, disburse the client’s share without unreasonable delay. If there’s a dispute over who is entitled to what, keep the disputed portion in trust until it’s resolved.

Advanced Fees vs. Non-Refundable Retainers

A common point of confusion is whether a retainer is “non-refundable” (earned upon receipt) or an advance that goes into trust. In Texas, the default assumption is that any advance fee or retainer is not earned until you do the work, unless it clearly meets the criteria of a true non-refundable retainer. A “true” non-refundable retainer (sometimes called a general retainer) is paid solely to secure the attorney’s availability (to prevent them from taking other work) and not for specific services. These are allowed in Texas only in limited circumstances – it must be reasonable, clearly agreed in writing, and typically reflects that you are likely turning away other work due to the engagement.

If you simply collect an advance fee for future services, you must deposit it in trust and only move it to operating as you earn it (for example, after billing hours against the retainer). Mislabeling an advance as “non-refundable” when it doesn’t meet the strict criteria is a recipe for trouble. The State Bar of Texas explicitly cautions attorneys to understand the difference between a true non-refundable retainer and a classic advance fee. Make sure your engagement letters spell this out, and when in doubt, err on the side of treating funds as trust money until earned.

Recordkeeping and Reconciliation

Texas requires that complete records of trust account funds be kept for five years after the representation ends. Practically, you should maintain detailed ledgers for each client matter showing all deposits, withdrawals, and the current balance for that client. Additionally, the State Bar strongly advises reconciling your trust account every month.

Monthly reconciliation means comparing your bank statement with your internal records (ledger or software) and resolving any differences. Each client ledger should add up to the total balance in the trust account. Regular reconciliation is not just bureaucracy – it’s how you catch errors or irregularities before they become big problems. Texas disciplinary authorities have anecdotally found that failing to reconcile is a common factor in trust account mismanagement.

Annual IOLTA Certification

Here’s a Texas-specific compliance step: attorneys must annually certify their IOLTA status with the Texas Access to Justice Foundation (usually when you renew your bar membership). You need to report whether you have a trust account, and if so, confirm the IOLTA details. Whenever you open or close a trust account, you must notify the Foundation within 30 days. Failure to comply with these IOLTA reporting requirements can result in administrative suspension. It’s an easy step to overlook, especially for new solo and small firm lawyers, so mark your calendar during bar dues time to complete the IOLTA compliance online form. It’s quick but very important for staying in good standing.

Texas law firms must keep client money separate, use IOLTA for small/short-term funds, follow strict procedures for handling and disbursing funds, and keep meticulous records. Always refer to Texas Disciplinary Rule 1.14 and related State Bar guidelines (like the Texas Bar’s “Lawyer’s Guide to Client Trust Accounts” resource) for detailed guidance. When you build your trust accounting practices around these rules, you protect your clients and your license.

Common Trust Accounting Mistakes (and How to Avoid Them)

Even well-meaning attorneys can slip up on trust accounting. Unfortunately, “I didn’t know” or “I forgot” won’t save you in a compliance audit. Here are some of the most common trust accounting mistakes Texas law firms make – and tips on how to avoid them:

Mistake #1: Commingling Funds

This is the cardinal sin of trust accounting – mixing client money with firm money. Commingling can be as blatant as paying your office rent from the trust account, or as subtle as leaving earned fees in the trust account too long. Either way, it’s prohibited. How to avoid it: Maintain dedicated trust accounts strictly for client funds. Never deposit client payments directly into operating (unless they’re truly earned fees or flat fees that your jurisdiction allows to be taken upfront).

Likewise, once you’ve earned fees in trust, transfer them out after invoicing – don’t let them sit in trust indefinitely. Keep a small cushion of firm funds only if needed to cover bank charges and if allowed by Texas rules (typically a minimal amount is permitted for fees). Otherwise, the equation is simple: client money in trust, your money in operating, no exceptions.

Mistake #2: Failing to Reconcile Regularly

If you’re not reconciling your trust account each month, errors will accumulate. You might miss a data entry mistake, an accounting software sync issue, or even theft. Many lawyers struggle with reconciliation – nearly 50% admit it’s a challenge to reconcile trust accounts properly – but ignoring it is not an option. How to avoid it: Set a strict monthly schedule for trust reconciliation. Whether you do it yourself, assign a staff member, or use software that automates much of the process, make sure that every month you compare the bank statement balance to your internal records and client ledgers.

Investigate even small discrepancies immediately. Regular, routine reconciliation will catch mistakes (like a check recorded twice or a bank fee taken out) before they snowball into ethics violations. Modern legal accounting software can facilitate three-way reconciliation (bank, trust ledger, and general ledger) to make this process easier.

Mistake #3: Inadequate Record-Keeping

Poor record-keeping is a silent killer. If you can’t produce a complete paper trail for every client transaction, you’re in trouble in an audit. This mistake includes not tracking individual client balances, failing to keep deposit slips and cancelled checks, or not retaining records for the required 5 years. How to avoid it: Implement a ledger for each client in addition to the overall trust account register.

For every deposit or withdrawal, record the date, amount, client matter, and purpose. Keep all documentation (receipt or invoice numbers, copies of checks, wire confirmations, etc.). It’s wise to use legal accounting software or at least spreadsheets dedicated to trust accounting rather than scratch pads or generic ledgers. Also, don’t close a matter file without ensuring you have all trust records ready to archive for the five-year retention period. Detailed records protect you if anyone questions a transaction down the line.

Mistake #4: Improper Withdrawals or Disbursements

Taking money out of the trust account at the wrong time or for the wrong reason is a serious breach. Examples include withdrawing fees before they are earned, paying a client A’s bills with client B’s money, or simply math errors that lead to overdrawing the account. Sometimes firms also get in trouble by not having proper authorization or backing documentation for a disbursement. How to avoid it: Touch client money only with good reason. Only withdraw funds from trust when they are due to be paid to someone – whether that’s transferring your earned fee to your operating account after sending the client an invoice, or paying a settlement or vendor on behalf of the client.

Always double-check the client’s available balance before any withdrawal to ensure sufficient funds for that client. Never “borrow” from one client’s balance to cover another’s. Have a rule that every trust check or electronic transfer is backed by clear documentation (an invoice, written client instruction, settlement statement, etc.). And of course, if you do accidentally over-disburse or discover a mistake, remediate it immediately – often that means promptly replenishing funds from your own pocket and notifying the client or authorities as required.

Mistake #5: Misclassifying Retainers or Fees

As mentioned earlier, confusion about retainers can lead to ethics issues. Some lawyers mistakenly treat advance fee retainers as instantly earned (depositing into operating) when they should remain in trust until work is performed. How to avoid it: Always clarify in your fee agreement the nature of the retainer or fee. If it’s meant to secure your availability and is truly non-refundable (a rare scenario), make sure it meets Texas’s criteria and get it in writing that the client understands this.

Otherwise, assume any advance payment is for future services and belongs in the trust account. When in doubt, put it in trust and draw it down as you earn it. It’s far better to err on the side of caution than to treat client funds as your own prematurely. Regularly educate your billing staff and partners on the correct handling of retainers so everyone is on the same page.

Mistake #6: Lack of Client Communication

Surprisingly, failing to keep clients informed can be a trust accounting pitfall. If a client doesn’t know how their funds are being handled, misunderstandings and disputes can arise. For example, a client might forget that a $5,000 retainer is in their trust and become upset upon receiving a bill that shows that money applied. How to avoid it: Practice transparency. Provide clients with updates on their trust balances, especially when sending invoices.

It’s a good practice (and in some states a requirement) to show any trust retainer balance on each bill. If you use a replenishing retainer model (where the client tops up when the balance falls low), clearly communicate those terms. When a matter concludes or if the client requests it, provide a full accounting of their funds. Open communication builds trust and prevents confusion about where the money went.

Mistake #7: Not Following Texas-Specific Rules

Each jurisdiction has quirks in its trust accounting rules, and Texas is no different – whether it’s the IOLTA reporting requirement, using eligible banks, or retaining records for 5 years. A common mistake is assuming that rules in another state (or the ABA Model Rules) are the same in Texas, or simply being unaware of a specific Texas requirement. How to avoid it: Stay educated on Texas’s rules. Review the Texas Disciplinary Rules and any guidance from the State Bar of Texas (the bar’s published guide on client trust accounts is a great resource).

Attend CLEs on legal ethics or law practice management that cover trust accounting. If you’re new to managing a trust account, consider a quick course or even the ABA’s Trust Accounting for Lawyers in One Hour book to get oriented. Also, ensure your bookkeeper or office manager understands these local rules – non-attorney staff might not instinctively know, for example, what “IOLTA” means or that they can’t pay a QuickBooks subscription out of the trust account. Make trust accounting training part of your firm onboarding. By being vigilant about jurisdiction-specific requirements, you’ll avoid unwitting violations.

By watching out for these common pitfalls and taking proactive steps to prevent them, you can keep your trust accounts clean. Remember, even an honest mistake can have outsized consequences in trust accounting. It pays to be detail-oriented and disciplined in this area. If something about the process isn’t clear, don’t hesitate to consult the State Bar of Texas resources or an accounting professional – a quick question today can save your license tomorrow.

Best Practices for Trust Account Management in Texas

Knowing what not to do is half the battle. Now let’s focus on proactive best practices that will make your trust accounting smooth, compliant, and virtually audit-proof. These tips will help your small or mid-sized firm stay on top of trust funds from day one:

Use Dedicated Trust Accounts (and the Right Type)

Open a separate IOLTA trust account at an approved bank for holding client funds that are small or short-term. Ensure the account is set up under your firm name with “Trust Account” in the title, so it’s clear whose funds it holds. For large client settlements or long-term holds, consider setting up a separate interest-bearing account for that client (and get the client’s tax info for interest reporting). Do not mix different fiduciary funds (for example, don’t use your attorney trust account for your role as an executor or realtor – each capacity should have its own account). Keeping accounts separate and clearly labeled prevents confusion and commingling.

Implement Strong Internal Controls

Treat trust money with the highest level of care. Limit who has access to the trust account and consider requiring two signatures for withdrawals above a certain amount (if practical for your firm). Use pre-numbered checks. Never use a signature stamp for trust checks. If you receive cash for a trust deposit (rare, but it happens), issue a detailed receipt and deposit it immediately – never leave client cash in a drawer. Every time funds move in or out, have a second person (if available) review the transaction and documentation. Small firms often have one person wearing many hats, but even a quick partner cross-check or an outside bookkeeper’s oversight can catch mistakes or irregularities.

Record Transactions Immediately and Meticulously

The moment you receive client funds, record it in your trust ledger (including whose money it is and why it was received). Likewise, log every disbursement with the date, payee, and client matter. Maintain a running balance for each client. By updating records in real-time, you’ll always know exactly how much belongs to each client and can avoid overdraws. It also makes reconciliation much easier because you’re less likely to forget what a transaction was weeks later. Modern practice management and accounting software will automatically create ledger entries when you receive trust payments or pay invoices from trust, which is a huge time-saver and error-preventer.

Reconcile Monthly (Three-Way Reconciliation)

We cannot overemphasize this: reconcile your trust accounts every single month. In Texas, monthly reconciliation is recommended at minimum. Best practice is a three-way reconciliation, which means: (1) the balance per your bank statement, (2) the balance per your accounting ledger (e.g., QuickBooks trust liability account), and (3) the sum of all individual client ledger balances – all three should match. This triple-match process is considered gold standard because it verifies that no money is unaccounted for in any dimension.

Many legal-specific accounting tools (including LeanLaw and others) can produce a three-way reconciliation report in minutes, but you can also do it manually with care. Document each reconciliation (save a PDF of the bank statement and a report of your ledgers with notes for any adjustments). If you find an issue (e.g., a bank error or accounting entry error), fix it immediately and note the correction. Consistent reconciliation is your best defense in a trust account audit – it demonstrates you’re actively monitoring the account and will catch any discrepancy before it harms a client.

Keep Client Trust Ledgers Up-To-Date

In addition to the overall trust account register, maintain a separate sub-ledger for each client or matter. This ledger shows that client’s transactions and current balance. Update these ledgers every time money moves. Best practice is to be able to produce a client trust statement on demand. In fact, if a client asks for an accounting of their funds, Texas rules require you to promptly provide it. Up-to-date ledgers make that easy. It also helps you when invoicing – you can include the trust balance on the bill or know how much to request as a retainer replenishment.

Disburse Funds Promptly and Properly

When it’s time to pay out client funds (whether to your firm or to the client/third parties), do it promptly and with proper documentation. If you’ve completed work and are billing from a trust retainer, transfer the fee to your operating account once the invoice is generated (and preferably, sent to the client). Do not delay transfers for too long – leaving earned fees in trust can be viewed as commingling in some cases.

For settlements or client money, as soon as conditions are met (e.g., the check clears, any hold period passes, and you have permission to disburse), get the funds to the client or pay the client’s bills. Prompt disbursement shows you’re not misusing the funds for other purposes. Always give clients a trust closing statement or some documentation of how their money was distributed, especially in contingent fee cases or settlements.

Plan for Uncleared Funds and Errors

Sometimes a client’s check bounces or a bank error occurs. Best practice is to monitor for any failed deposits or corrections from the bank. If a deposit bounces, you’ll need to immediately make that ledger right (which could mean your firm covering any shortfall if you already disbursed money assuming the funds were there – another reason to wait for actual clearance before spending client funds).

Maintain a small firm-funds buffer if your bank allows (e.g., $100 of firm money in the trust account to cover any inadvertent bank fees or shortfalls, which Texas likely permits as not constituting commingling for nominal amounts). This ensures one client’s bounced check doesn’t accidentally dip into another client’s funds. Always clear up any negative balance in a client ledger immediately using firm funds – you never want a client ledger to show a deficit.

Retain Records and Close Accounts Methodically

When a matter is over and you’ve disbursed all funds, provide the client a final accounting and close out their ledger. If an account remains inactive with a zero balance, formally close it in your books. Keep all trust accounting records – bank statements, cancelled checks, ledgers, reconciliation reports, deposit slips – for at least five years (Texas requires 5-year retention, but some firms keep 7-10 years for good measure). Store these records securely (consider electronic copies for backup).

If you close your practice or a trust account, follow the State Bar guidelines for notifying the Texas Access to Justice Foundation and ensure remaining client funds are returned or transferred to a new custodian. Proper wind-down procedures are part of best practices too.

Leverage Automation and Safeguards

Don’t rely on memory and manual effort for everything. Today’s legal tech tools can automate much of trust accounting while enforcing rules. For example, some software will prevent you from overdrawing a client’s trust balance or will warn you if a transaction looks like commingling. Many practice management systems integrate with payment processors like LawPay to ensure credit card fees don’t hit your trust account (a common pitfall if using generic merchant accounts).

Utilizing software with built-in trust accounting features (such as generating three-way reconciliation reports or segregating ledgers) adds a layer of protection. We’ll discuss more on tech solutions in the next section, but as a best practice, consider adopting a system that is designed for lawyer trust accounts rather than relying on generic accounting templates.

Stay Educated and Train Your Team

Laws and regulations can change. (For instance, Texas updated some trust accounting rules in recent years, and other states like California introduced new reconciliation requirements.) Make it a habit to periodically review any rule changes or ethics opinions concerning trust accounts. Send your bookkeeper or office manager to training if they’re unfamiliar with legal trust requirements. The investment in knowledge pays off massively by preventing errors. Additionally, cultivate a culture of compliance at your firm – emphasize to associates and staff that everyone is responsible for protecting client funds. Encourage people to speak up if they spot something odd or have questions. It’s much better to address a potential issue early than to ignore it.

By implementing these best practices, your law firm will not only stay compliant with Texas rules but also run a tighter financial ship. Trust accounting will become a routine, manageable part of operations – not a constant source of anxiety. You’ll have the peace of mind that if the State Bar of Texas ever audits your trust account, you’ll be ready with organized records and a clear story for every client dollar.

How Legal Tech Can Simplify Trust Accounting (and Boost Compliance)

Trust accounting has a reputation for being tedious and complex, especially for small firms without a full-time accountant on staff. The good news is that you don’t have to manage it all with pen, paper, and stress. Legal technology – particularly software tailored to law firm accounting – can automate and streamline much of the trust accounting process. Texas firms increasingly are adopting tech tools to help them stay compliant with less effort. Let’s explore how leveraging technology (including tools like LeanLaw, which integrates with QuickBooks Online) can make trust accounting easier and more foolproof:

Integration with Accounting Software

One of the game-changers is using legal-specific software that integrates deeply with mainstream accounting platforms. For example, LeanLaw’s trust accounting feature is built on a tight integration with QuickBooks Online (QBO). This means every trust transaction you handle in LeanLaw is automatically reflected in QuickBooks in real time. No double data entry, no syncing lag, no inconsistencies between your billing system and your books.

Why does this matter? Because it prevents the scenario where your practice management software says one thing and your accounting ledger says another – a common source of errors. With an integrated system, your trust ledger, your bank feed, and QuickBooks are always in sync. LeanLaw, for instance, was designed so that your trust account in QuickBooks never falls out of balance with your records; manual reconciliation becomes largely a thing of the past. In short, integration = accuracy + less work for you.

Automatic Three-Way Reconciliation

As we mentioned, three-way reconciliation is a best practice – and some legal tech will handle a big chunk of it automatically. LeanLaw and similar legal accounting platforms can continuously match your trust bank account, client ledgers, and QuickBooks balances. Instead of spending hours every month cross-checking, you can generate a reconciliation report with a few clicks.

This not only saves time but also gives you confidence that your trust accounts are balanced to the penny. If there’s a discrepancy (say a transaction wasn’t logged), the software will flag it immediately. By automating reconciliations and providing audit-ready reports 24/7, tech tools let you focus on practicing law rather than poring over spreadsheets.

Built-in Compliance Safeguards

Good legal accounting software is built with ethics rules in mind – essentially acting like a safety net. For example, LeanLaw’s trust accounting module enforces separation of funds: it will require you to designate a bank account as a trust account and won’t let you apply trust money to a bill unless that client has enough funds available. It keeps an immutable record of every trust transaction linked to the client matter, creating an audit trail.

Some software will prevent common mistakes like accidentally putting a trust deposit into income or will automatically offset credit card processing fees to the operating account (so your IOLTA isn’t touched by fees). These little safeguards mean that even if you or your staff aren’t experts in trust accounting, the software architecture guides you to do the right thing by default. Think of it as having a built-in compliance officer who never takes a day off.

Trust Requests and Online Payments

Managing retainer replenishments and payments into the trust can be simplified with tech as well. Rather than asking clients to mail checks (and then manually tracking them), many firms use online payment solutions that are IOLTA-compliant. For instance, LeanLaw integrates with electronic payment systems (like its Confido integration) to allow clients to deposit retainers or pay bills directly into the trust account electronically.

These systems ensure that the payments go to the right account and often prevent any trust account debits. Using a solution like LawPay (popular among Texas lawyers) or LeanLaw’s integrated payments means you can email a client a link to pay a retainer by credit card or ACH, and the funds land in your trust account with notifications and records automatically created. No more guessing whose check just arrived or forgetting to log a deposit. Plus, clients appreciate the convenience – and you get the retainer in faster, improving cash flow.

Seamless Trust-to-Invoice Workflow

One pain point for lawyers is tracking how and when to use client funds for invoices. Legal billing software like LeanLaw links the trust account with your invoicing. For example, when you create an invoice for a client who has funds in trust, the software can earmark that invoice to be paid from trust. Once you approve it, LeanLaw will deduct the amount from the client’s trust balance and mark the invoice paid, all in one or two clicks. It will even handle the accounting entry to move that amount from the trust liability to income in QuickBooks.

Essentially, the software turns what could be a multi-step, error-prone process (generate invoice -> receive payment -> apply trust -> cut check to operating) into a simple, guided workflow. This reduces the risk of forgetting to transfer funds or double-billing. As LeanLaw’s team puts it, what used to be a daunting 12-step process in QuickBooks can become just a few clicks with the right tool.

Real-Time Trust Balance Visibility

Another benefit of technology is dashboard insights. Rather than flipping through a paper ledger or Excel sheet, you can at any moment see a real-time balance of your trust account and each client’s funds on your screen. LeanLaw, for instance, provides at-a-glance trust account balances and even allows you to display the client’s trust balance on their invoice automatically.

Real-time visibility means no surprises – you’ll know if a client’s retainer is running low before it’s time to bill again, and you can ask for replenishment proactively. It also means if someone asks “How much do we hold for Client X?”, you can answer in seconds with confidence. In a busy practice, that situational awareness is invaluable.

Mobile and Remote Access

With cloud-based trust accounting tools (LeanLaw is cloud-based, integrated with QBO which is also cloud), you aren’t tied to a single office computer for managing trust funds. You can receive a notification on your phone that a client paid a retainer via eCheck, or log in from home to verify the trust balance before writing a settlement check.

This flexibility ensures that even if you are a small operation without an accounting department, you can stay on top of trust accounting on the go. Just remember to maintain good security practices (strong passwords, two-factor authentication) since sensitive financial data is accessible online – the convenience is great, but protect it like you would your online banking.

Audit Trails and Reports

If the phrase “audit by the State Bar” makes you nervous, legal tech can provide some peace of mind. Most legal accounting software will have built-in reports: client ledger reports, trust account balance reports, bank reconciliation reports, etc. In the event of an audit (or even just an internal review), you can generate these reports for the required period and hand them over, confident that they are accurate and complete.

For example, LeanLaw’s trust reports can show every transaction that happened in a given timeframe, tied to matters and users, which is ideal for demonstrating compliance. Some tools even offer a compliance checklist or workflows to ensure you’ve done all the steps (deposit, invoice, transfer, reconcile, etc.). Essentially, you’re leveraging the software’s capabilities to be audit-ready 24/7. That means less scrambling if you ever get that dreaded letter from the Bar.

Integration with QuickBooks Online

Many small firms in Texas use QuickBooks Online for their general bookkeeping. The right legal tech (like LeanLaw) is purpose-built to work with QuickBooks in a law firm context. LeanLaw is in fact a premier app for law firms in the QuickBooks App Store. By using LeanLaw in tandem with QuickBooks Online, you get the best of both worlds: law-specific trust accounting features plus robust general accounting. For example, LeanLaw will automatically set up the proper QuickBooks chart of accounts for trust accounting (including a trust bank account and a trust liability account) with one click.

It handles the complex entries behind the scenes, so your QuickBooks financial statements are always correct regarding client funds. And because it’s cloud-based, your bookkeeper or CPA can log into QuickBooks Online and see everything accurately reflected. This deep QuickBooks integration eliminates the common headaches of using generic accounting software for trust funds. Instead of forcing QuickBooks to do something it doesn’t natively do well, LeanLaw bridges that gap and lets QuickBooks be the “source of truth” while keeping you compliant.

Technology can automate away the drudgery and fear of trust accounting. For a Texas law firm, tools like LeanLaw’s legal billing software (which includes robust trust accounting and QuickBooks Online integration), or other reputable legal accounting platforms, are worth the investment. They’ll save you time, reduce human error, and embed compliance into your daily workflow. Instead of manually tracking every penny and worrying about mistakes, you can rely on software that is designed around Texas trust accounting rules and best practices.

Of course, technology is not a complete substitute for understanding the rules – you still need to know what’s supposed to happen and review your reports – but it’s a powerful assistant. Think of it as “trust accounting on autopilot” (with you as the pilot monitoring the gauges) (Trust Accounting & LEDES Billing Software | LeanLaw) (Trust Accounting & LEDES Billing Software | LeanLaw). Many small and mid-sized firms in Texas have found that using legal tech for trust accounting gives them peace of mind: they can focus on client work knowing that client funds are handled correctly in the background.

Texas Trusting Accounting

Trust accounting may never be the most glamorous part of running a law firm, but it is absolutely one of the most important, especially in Texas where compliance standards are high and enforced diligently. By understanding the why and how of Texas trust accounting – from the ethical imperative and state rules to the common pitfalls and best practices – your firm can turn what is often seen as a burden into a well-managed routine. The keys are education, consistency, and the smart use of tools.

Small and mid-sized law firms don’t have to feel overwhelmed by trust accounting. Start by implementing the fundamental best practices: keep funds separate, document everything, reconcile regularly, and never touch client money without authorization. Layer on Texas-specific requirements like IOLTA participation and annual reporting so you’re compliant with local rules. Foster a culture in your firm that treats client funds with the utmost care – every team member should know that trust money is sacrosanct.

Finally, don’t shy away from leveraging legal tech solutions to make your life easier. Whether it’s adopting LeanLaw’s trust accounting software for its seamless QuickBooks Online integration and compliance safeguards, or another platform, modern software can dramatically reduce the risk of error and save you countless hours. It’s like having an extra (very meticulous) staff member who never makes mistakes on the trust ledger.

With the right practices and tools in place, trust accounting can go from a source of stress to a source of strength for your firm. You’ll protect your clients’ funds, strengthen your firm’s financial footing, and sleep easier knowing that you are doing things by the book – the Texas book, to be precise. In the long run, a reputation for rock-solid trust accounting is part of what will mark your law firm as professional and trustworthy. And that trust is the foundation upon which successful attorney-client relationships – and law practices – are built.