Like most states across our country, any law firm that is holding on to client funds in New Jersey must set up an attorney trust account in order to deposit those funds accordingly.

It is widely known in the field of law that clients’ funds should never be mixed into a general operating account, regardless of the size of the law firm or what type of law is being practiced.

Violation of this rule, even if there is no potential harm to the client, could eventually result in the attorneys or the law firm itself facing large fines or other consequences.

In severe cases, there may be other ramifications such as criminal charges and civil litigation that could be brought forth as well.

Having the most accurate legal accounting software available is going to help any attorney or law firm ensure that all of their bank accounts are being handled in a way that allows for complete compliance with the law as well as transparency to their clients, their community, and any governing bodies in their state.

Let’s look more closely at how the state of New Jersey handles the rules and regulations set forth around IOLTA trust accounts.

What Is a New Jersey IOLTA Account?

Though Florida was the first state to establish an IOLTA program, New Jersey quickly followed suit.

By 1988, the “Garden State” had its own, fully established program.

New Jersey’s IOLTA fund was originally optional for attorneys and law offices across the state, but by January 1993, the New Jersey Supreme Court ruled that all New Jersey lawyers and law firms that wanted to practice in the state had to have an attorney trust account in operation.

Schedule a demo

IOLTA is an acronym for Interest on Lawyers Trust Accounts. An IOLTA account allows for a law firm to set aside their client’s retainer fees in an interest bearing account and insure that those client funds don’t mix with any of the firm’s other banking accounts that need to be used for that firm’s operating expenses.

The interest earned on an IOLTA fund in New Jersey is then transferred to the state’s IOLTA program and is used for civil legal aid that will be directed at helping those who are underserved or unable to fund their own legal expenses

Oftentimes, some of these monies may also be used to fund grants in the state, help support scholarships for students in need, or be used for other justice related services as deemed appropriate by the IOLTA Board of Trustees.

In New Jersey, an IOLTA fund is managed and appropriated by the bar of New Jersey, which follows stringent guidelines to guarantee that all dollars coming from lawyers’ trust accounts are being handled in accordance with the ruling of the state’s Supreme Court.

How Do I Determine if a Client’s Retainer Should be Placed in an IOLTA account?

In the state of New Jersey, there is no hard and fast rule as to what determines whether or not a client’s funds (or retainer, as it’s often called) should be placed in an IOLTA account or in a separate account set up at a financial institution.

Most law firms follow the best practices guidelines that typically suggest placing client funds in an IOLTA account when they are not substantial enough to warrant their own banking account, or when the client is being represented for one specific case or period of time.

New Jersey attorneys will need to use their own guidelines and judgment to decide whether a client’s trust funds should be placed in a separate, interest-bearing account – where the interest will be paid back to the client – or whether that particular client’s funds would be better off being placed in the firm’s IOLTA fund – where the interest will then be transferred to the state’s IOLTA program.

That said, the larger the client’s retainer is, the more likely you will place it in its own trust account at your financial institution of choice.

How Do I Set Up My IOLTA Account and Make Sure It’s Managed Appropriately?

Though setting up an initial IOLTA account is relatively straightforward, you will want to make sure that the financial institution you choose is capable of adhering to all rules and regulations surrounding the program.

The bar of New Jersey takes the state’s IOLTA fund very seriously, and there can be significant consequences to an attorney or a law firm if IOLTA funds are not managed and handled properly.

One best way to ensure that your firm is in full compliance with the IOLTA fund laws is to use legal accounting software that is specifically designed for this program.

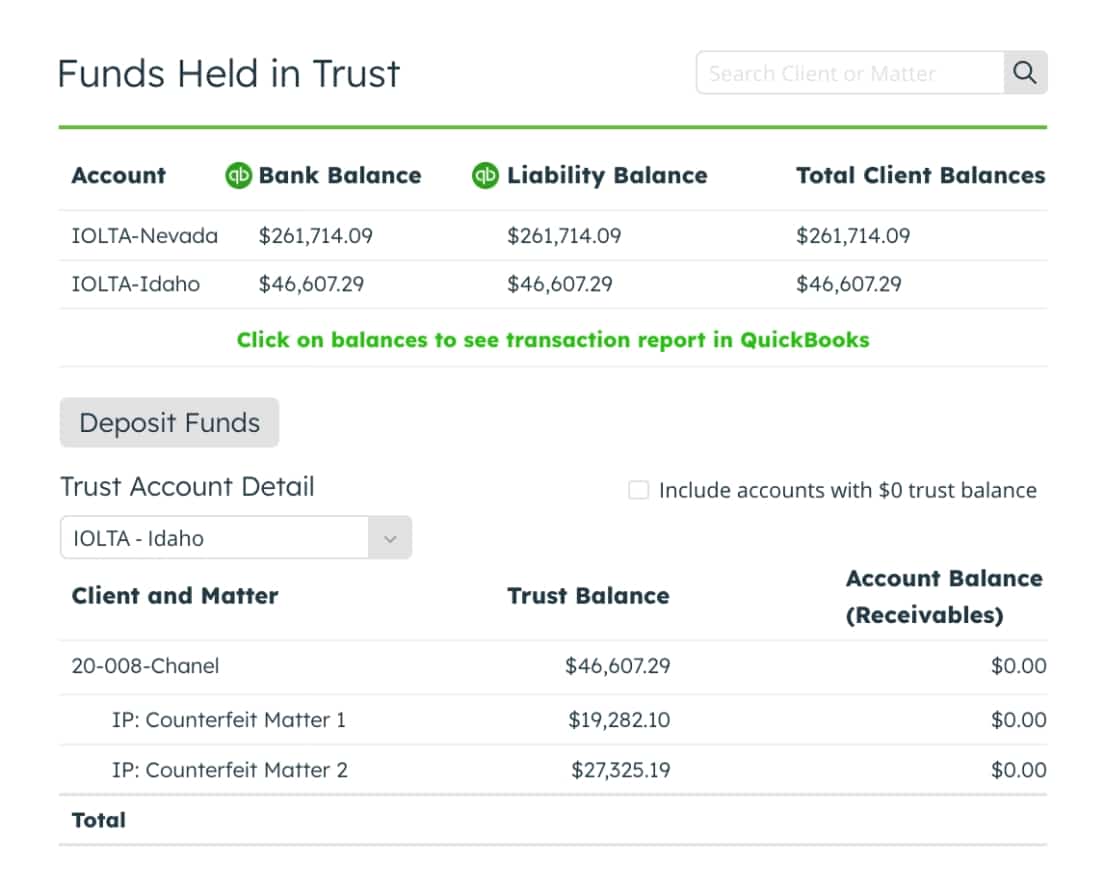

LeanLaw has created trust accounting software that will not only keep your firm in full compliance with IOLTA fund state laws, but will also help keep all of your various accounting tasks organized and easy to navigate and understand.

From making sure your client’s funds stay separate from your operating funds, to creating client ledges and invoices, LeanLaw accounting software was designed to save you hours of time, while also increasing cash flow and keeping your firm in compliance with all state and federal regulations.

If you’re interested in seeing what LeanLaw could do for your law firm, request a demo from us today. You’ll be surprised you didn’t do it sooner.