Managing Interest on Lawyers’ Trust Accounts (IOLTA) in QuickBooks Online can be challenging, but it’s a critical responsibility for law firms. Client trust funds must be handled with utmost care and accuracy – mismanaging these accounts can lead to serious ethical violations and even disciplinary action (in extreme cases, attorneys have been suspended or disbarred for trust account mismanagement). The good news is that with the proper QuickBooks Online workflows and safeguards, you can keep your IOLTA in order and in compliance.

In this post, we’ll explore best practices and common pitfalls for managing IOLTA using QuickBooks Online, from setting up your accounts correctly to handling day-to-day transactions. We’ll also highlight how leveraging legal-specific software like LeanLaw can simplify and automate trust accounting tasks, giving you greater confidence in your compliance. (For a primer on trust accounting fundamentals, see our Trust Accounting 101 guide on the LeanLaw blog.)

Understanding IOLTA and Why It Matters

First, a quick refresher: IOLTA stands for Interest on Lawyers’ Trust Accounts. These are special interest-bearing bank accounts used to hold client funds that are small in amount or held for a short period (such as retainers or advance fee deposits). By law, the interest generated on IOLTA accounts doesn’t go to the law firm or the clients; instead, banks forward that interest to state-run IOLTA programs, which fund legal aid and other public interest causes.

In practice, an IOLTA acts as an umbrella trust account where you might commingle multiple clients’ funds in one account – but only for client funds, never your own. This is allowed because the funds are nominal or short-term; if a client deposits a large sum or for a long duration, typically a separate interest-bearing trust account would be opened for that client’s benefit.

Trust accounting refers to the bookkeeping of all these client funds. Every dollar in the IOLTA is money that belongs to someone else, so it must be safeguarded and tracked diligently. Key ethical rules (in every jurisdiction’s Bar rules) include never commingling client trust funds with the firm’s operating funds, keeping detailed records of each client’s balance, and reconciling the trust account regularly.

The stakes are high – even unintentional mistakes (like accounting errors that show a client had less money than they actually did, or using one client’s funds to cover another’s expenses) can signal a violation of fiduciary duty. That’s why bar regulators often require rigorous reporting and audits of trust accounts. Fortunately, QuickBooks Online has the tools to help you stay on top of trust accounting, as long as you set things up correctly and follow disciplined workflows.

Setting Up IOLTA Accounts Properly in QuickBooks Online

1. Establish a Dedicated Trust Bank Account: In the “real world,” your IOLTA is a separate bank account (at a bank approved for trust accounts). In QuickBooks Online (QBO), you need to mirror this by creating a distinct bank account in the Chart of Accounts for the IOLTA. Go to Chart of Accounts > New, choose Bank as the account type (likely a checking account), and name it something clear like “IOLTA Trust Account.” This ensures all client funds transactions will be kept separate from your operating finances in the books. Keeping trust funds segregated is non-negotiable – never deposit client money directly into your firm’s operating account.

2. Create a Trust Liability Account: Next, set up a corresponding liability account to represent the money you owe to clients. In QBO, create a new Other Current Liabilities account called “Client Trust Liabilities” (or similar). This acts like a holding bucket for all client funds. Every dollar in the IOLTA bank account should be backed by a liability entry showing that you owe that money to someone.

Think of it this way: the bank account is the actual funds, and the liability account is the aggregate ledger of what’s owed to all clients. We’ll track individual client shares in a moment. (In accounting terms, when client money comes in, you’ll debit the IOLTA bank and credit this liability, keeping the books in balance.)

3. Set Up Sub-Accounts for Each Client (Client Ledgers): To manage balances per client, it’s highly recommended to use sub-accounts or another tracking method under the main trust liability. One popular approach is to create each client as a sub-account of the “Client Trust Liabilities” account. For example, under “Client Trust Liabilities,” you might have “Client Trust – John Smith,” “Client Trust – Acme Corp,” etc. Each of those is an Other Current Liabilities type account designated as a sub-account of the main trust liability parent.

This way, QuickBooks will keep a separate running total for each client and roll them up into the total liability. It becomes very easy to see how much money each client has in trust by running a balance sheet or QuickReport on that sub-account. This sub-account method is recommended by many legal accounting professionals as a straightforward way to use QBO for trust accounting. (Alternative methods: Some firms use the customer list and Class tracking to allocate trust funds by client, or use QBO Projects. Those can work, but sub-accounts tend to be simpler for trust ledgers in QuickBooks Online.)

4. Configure Opening Balances (if applicable): If you are just setting up QuickBooks and already have existing trust funds in the bank, you’ll need to enter those balances. The best practice is usually to create the accounts as described without an opening balance, and then record a deposit for each client’s existing funds into the new IOLTA account so that it properly posts to their sub-account. For instance, if John Smith has $5,000 in trust from before, do a Bank Deposit to the IOLTA account, Received from John Smith, and assign it to John Smith’s trust liability sub-account (more on this process below). This records the starting liability and puts the money in the bank account in QBO, aligning with what’s actually in the real bank. Avoid using a lump-sum opening balance on the bank account without breaking it out by client, or you’ll lose the client-level detail.

With the Chart of Accounts set up like this, you have laid the foundation. The IOLTA bank account and the total of all the client sub-accounts should always mirror each other. For example, if your IOLTA bank has $100K, your “Client Trust Liabilities” parent account might total $100K, composed of, say, $40K for Client A, $30K for Client B, $30K for Client C sub-accounts (just an illustration). Our next steps will ensure they stay in sync.

Tracking Client Trust Funds Accurately in QBO

Once your accounts are ready, your daily workflow will involve putting money in and taking money out of the IOLTA, in a way that credits or debits the correct client’s balance. QBO can handle this smoothly if you follow a consistent method:

Recording a Trust Deposit (Client Retainer or Funds)

Whenever you receive money from a client that needs to go into trust (e.g., a retainer check, settlement amount, etc.), deposit it only into the IOLTA bank account. In QuickBooks Online, use the + New > Bank Deposit screen. Select the IOLTA bank account at the top of the form. On the line item, set the following: “Received From” = the client’s name (you should have the client set up as a Customer in QBO for this purpose), “Account” = the client’s trust liability sub-account.

For example, Received from John Smith, Account = “Client Trust Liabilities: John Smith”. Enter the amount of the check. This single entry will increase your IOLTA bank balance and simultaneously increase the liability you owe to that client. Optionally, fill in the Description/Memo (e.g., “Initial retainer for Case X”) for clarity. Save the deposit. Pro tip: Do not use the Receive Payment or Sales Receipt for retainers that go to trust, because those are meant to link to invoices or income. A Bank Deposit tied to a liability account is the correct way in QBO to record client money that isn’t income to the firm.

Now, QBO will show that client’s sub-account has, say, $5,000 credit balance (meaning you owe them $5,000), and the IOLTA bank account has $5,000 more in it. If you look at a Balance Sheet, the asset (bank) and liability (trust) increased equally – exactly what we want.

Recording a Trust Disbursement (Paying an Expense from Trust)

It’s common in some cases to pay certain costs directly from the trust account. For example, you might pay a court filing fee from the client’s funds, or in a personal injury case, disburse settlement funds to the client from the trust bank. To record this in QBO, you’d use either a Check or an Expense transaction (they function similarly for our purposes). Go to + New > Expense (or Check), make sure the payment account is the IOLTA bank account (since the money is leaving that bank).

Then, on the category line, choose the appropriate client’s trust liability sub-account under “Category.” This decreases that client’s trust balance (liability) and reduces the bank account by the same amount. For the payee, select who the money is going to (e.g., the court, the client themselves, a vendor). In the description, note what it’s for (e.g., “Filing fee for John Smith case – paid from trust”). This way, QuickBooks records that you spent, say, $300 of John Smith’s funds on a filing fee – John’s trust sub-account will go down by $300 and the IOLTA bank account will drop $300 accordingly. Always double-check that you assign the correct client’s sub-account for any trust expense, so you don’t accidentally dock the wrong client’s balance.

Transferring Funds to Your Operating Account (for Earned Fees)

The most frequent scenario is that you’ve done work for the client and now need to pay yourself from the client’s trust money. Typically, you’d invoice the client for the work (creating an invoice in QuickBooks for your fees and costs). Then you use the funds in trust to pay that invoice. QuickBooks Online doesn’t have a one-click “apply trust to invoice” feature, so the process involves a couple of steps.

One common workflow is: Write a Check (or do a Bank Transfer) from the IOLTA account to your firm’s operating account. For example, you might write a check with payee as your law firm (or use a Transfer funds transaction in QBO from IOLTA bank to Operating bank). That check/transfer should be categorized to the client’s trust liability sub-account, just like an expense. Essentially, you’re moving $X from the client’s trust to the firm. Important: do not categorize it as income – it’s still moving the client’s money on the books (from trust to operating).

By categorizing to the liability sub-account, you reduce the amount owed to the client. Then, you would record the invoice as paid (receive payment in QBO) by depositing it to your Operating bank account. In effect, you’ve taken $X out of trust and paid off the $X invoice. If done correctly, the client’s trust sub-account decreases by the fee amount, and your operating bank increases by that amount, while your income from the invoice is recognized as usual.

Keep in mind that until you do the actual bank transfer (moving the money at the bank), the QBO books and the real world won’t match – so always actually transfer the funds when you record these transactions when you pay yourself. This ensures there’s no discrepancy between the trust account balance in QuickBooks and what’s really in the bank.

Client Refunds from Trust

If you need to refund any remaining balance to a client (e.g., at the conclusion of a matter the client has money left in trust), you will essentially do the reverse of a deposit: write a check from the IOLTA to the client (the payee is the client), categorize it to that client’s trust liability sub-account. This reduces their balance to zero. Make sure the memo says it’s a return of unused funds. After that, your books will show no more liability for that client and the bank account will be lower by that amount – and the client gets their money back. Keep copies of any such refund checks as part of your documentation.

With these steps, every transaction in or out of the IOLTA is properly tracked to a client. QuickBooks Online can now produce a “client ledger” for each trust sub-account to show all deposits and withdrawals for that client. This is extremely helpful for compliance – if a bar auditor asks for a record of how you handled Client X’s money, you can pull up their sub-account activity (or run a custom report filtered by that client’s name or sub-account).

Tip

Consistently use the Customer field on trust transactions as well (QBO allows you to tag an Expense or Check to a Customer/Project). For example, when writing a trust check for John’s filing fee, select John as the Customer on the expense screen. This way, you have another way to filter reports by client/matter. It can be redundant if you already use sub-accounts per client, but it doesn’t hurt – it provides belt-and-suspenders identification of whose money was used for what.

Many find the sub-account method sufficient, but those who prefer not to clutter the Chart of Accounts with many sub-accounts might rely on using the Customer field + a single liability account. Either method, as long as it’s executed correctly, can work – just don’t mix methods without understanding it, or you could double-count.

The bottom line is to always ensure each trust transaction in QuickBooks has two key pieces: the IOLTA bank account and the specific client’s identifier (sub-account or equivalent). This keeps client funds separate and traceable.

Ensuring Compliance with Trust Accounting Rules

Beyond just recording transactions, you need to adhere to the spirit of trust accounting regulations. Here are some best practices and compliance tips to implement alongside your QBO workflows:

Maintain Separation of Accounts (No Commingling)

Never mix client trust money with your firm’s own funds. This means in practice you should have a separate bank account (the IOLTA) for all trust monies, which we’ve set up in QBO. Don’t pay personal or firm expenses directly out of the trust account – only pay disbursements that are for that client. The only exception allowed (in most jurisdictions) is that you can keep a small amount of firm money in the trust account solely to cover bank service charges.

For example, if your bank charges a $25 monthly fee and it isn’t waived for IOLTA accounts, the Bar might allow you to deposit $100 of firm money into the IOLTA as a cushion for those fees. Check your state’s rule on the maximum amount (often a few hundred dollars at most). Any other use of the trust funds for the firm’s benefit is strictly forbidden. Using one client’s money to pay for anything unrelated to that client is considered commingling or conversion, and that’s a big ethics violation. QuickBooks helps avoid commingling by clearly separating the accounts – just be sure you and your staff always select the correct accounts when entering data.

Account for Interest and Bank Fees Properly

In an IOLTA, interest belongs to the state’s IOLTA fund. Usually, the bank handles sending the interest out to the Bar foundation. However, in QuickBooks you should still track interest transactions to ensure the bank account matches. One way is to create a sub-account under the trust liability called “IOLTA Interest (Bar)” to accumulate interest that will be paid out to the Bar. When the bank credits interest, record a deposit in QBO for that interest amount to the IOLTA bank and assign it to the “IOLTA Interest (Bar)” liability sub-account (since that interest is owed to the Bar program, not to any client).

Similarly, when the interest is remitted or swept by the bank, record a check or expense from IOLTA bank assigned to that “IOLTA Interest (Bar)” account. This way, that sub-account should net to zero over time after each interest payout. If your bank deducts service fees from IOLTA, it’s a bit tricky: many bars require that the lawyer must cover those fees, not the clients. This means you should replenish the account with firm funds to offset any charges. For example, say the bank takes a $15 wire fee out of IOLTA.

You should record an expense for $15 from IOLTA categorized to “Firm Funds for Bank Fees” (a sub-account under trust liability for firm’s own funds). That will show a negative $15 (the trust owes the firm $15). Then you transfer $15 of firm money into IOLTA and record that deposit to the same “Firm Funds for Bank Fees” sub-account, bringing it back to zero. This reflects that the firm, not clients, ultimately paid that fee. The key is to ensure bank charges don’t eat into client balances – your bookkeeping should demonstrate that either interest or the firm’s funds covered those costs.

Know Your State’s Trust Accounting Rules

Each state bar has its own set of trust accounting rules, though they share common themes. Familiarize yourself with requirements like: how often you must reconcile (typically monthly), whether you must send annual trust balance statements to clients, how quickly you must remove earned fees from trust, etc. For instance, some state bars or ethics opinions require that every client invoice shows the remaining trust balance for that client after any withdrawal. QuickBooks alone doesn’t automatically put a trust balance on an invoice, so you’d have to manually add that information or use an add-on tool.

Also, many jurisdictions insist on a three-way reconciliation report every month (more on that below). The rules might feel burdensome, but they are meant to protect you as well as the client. Staying compliant will save you from headaches in a bar audit. A good practice is to schedule a monthly routine (perhaps a week after you get the bank statement) to reconcile and run required reports. Also, consider reviewing resources from your state bar or the ABA – for example, state bar trust accounting handbooks often outline the do’s and don’ts. (The ABA also notes that trust account issues are one of the leading causes of disciplinary actions, so it’s worth the extra care!). If you’re unsure about a regulation, reach out to your state bar’s ethics hotline or consult a legal accountant.

Document Everything Meticulously

Treat your trust account with the mindset that one day you’ll need to prove every penny. Keep a copy of every deposit slip, check, wire confirmation, etc., related to the IOLTA. In QuickBooks, use the Memo field generously – note client names, matter info, reason for payment, etc. When you look back at a transaction two years from now, you shouldn’t have to guess what it was.

Good documentation makes audits or even simple client inquiries much easier to handle. QBO’s audit log will record any changes to transactions, which is helpful, but the clarity of descriptions is up to you. Many firms also keep a manual or Excel log of all trust transactions as a backup, but if you use QBO carefully, that may be redundant. Still, exporting a monthly report (like transaction detail by client) and saving it can’t hurt.

Regular Reviews and Oversight

Even if you’re a solo, try to have a second pair of eyes review the trust accounting occasionally. This could be your bookkeeper, an outside accountant, or at least, you after stepping away for a day. One of the recommended internal controls is to have someone other than the person writing trust checks do a periodic review of the trust records. The idea is to catch mistakes or irregularities – for example, an entry posted to the wrong client – before they become bigger issues.

Additionally, some firms implement a policy that two signatures are required on large trust disbursement checks as a safeguard against improper withdrawals. While that’s more of an internal firm policy than a QuickBooks feature, you can reflect some of that control by reviewing reports. Essentially, trust but verify – even within your own bookkeeping.

By following these practices, you create a safety net around your trust accounting. QuickBooks Online will be the tool to execute the mechanics, but your policies and habits ensure those mechanics are used correctly. Many of these points might become second nature: for example, you’ll get used to always selecting the IOLTA account and correct client sub-account for certain transactions. That consistency is what keeps you compliant.

Handling Trust Account Reconciliation

Reconciling a trust account is not just a bank reconciliation – it’s a three-part reconciliation: the bank, the books, and the individual client ledgers all must match. QuickBooks Online’s bank reconciliation feature will cover the bank vs. books part, but you should also run reports to cover the third part (client ledgers).

Monthly Bank Reconciliation

Just as you (hopefully) reconcile your operating bank account in QBO each month, do the same for the IOLTA bank account every month without fail. Go to Accounting > Reconcile, choose the IOLTA account, and enter the statement’s ending balance and date. Reconcile the account by checking off all deposits and withdrawals, making sure the cleared balance in QBO matches the bank statement.

This process will catch things like a data entry mistake (e.g., you entered $950 instead of $590, or duplicated a transaction) or transactions that didn’t clear (like maybe a check hasn’t been cashed yet). If you find items on the bank statement that aren’t in QuickBooks, investigate immediately – for example, a bank service charge or interest credit you didn’t record. Likewise, anything in QBO that isn’t on the statement (like an old outstanding check) needs attention.

The goal is a zero discrepancy. Trust account reconciliations are often scrutinized by auditors, so retain copies of the reconciliation report each month (QBO lets you print or save a PDF of it). In fact, many law firms are required to have a report each month showing that the trust’s general ledger and bank statement were reconciled. QBO makes this easy if you do it regularly. It’s the foundation of proving you’re handling the account correctly.

Three-Way Reconciliation

After reconciling the bank to the QBO account, you need to ensure that the total client liabilities equal that reconciled balance, and that each individual client balance is correct. A “three-way reconciliation” means: (1) the bank statement balance, (2) the QuickBooks IOLTA bank account balance, and (3) the sum of all client trust balances (ledgers) all agree. To do this in QuickBooks Online, you can run two reports: Balance Sheet (as of the reconciliation date) filtered to just the IOLTA bank and trust liability accounts, and a Trust Liabilities Detail report.

For the latter, one method is to run a Transaction Detail by Account report, filter it to the “Client Trust Liabilities” parent account, and group by Account to see each sub-account’s total. Alternatively, if you have sub-accounts per client, a simple balance sheet will already show sub-totals by sub-account. The total of all sub-accounts should equal the parent account total, which should equal the bank balance. For example, if the bank statement says $50,000, QuickBooks’ reconciliation ending balance is $50,000, you might see Client A $20k, Client B $30k which adds up to $50k in liabilities.

That’s a three-way match. If something is off – say the sub-accounts add to $49,000 but bank is $50,000 – you have an issue to resolve (perhaps $1,000 of interest that is in the bank but not yet assigned to a client or to the Bar, etc.). Many states require you to keep a record of each monthly three-way reconciliation (often a simple worksheet or PDF of the reports). LeanLaw (as we’ll discuss) and other software can automate generating a three-way reconciliation report.

But even in plain QuickBooks, it’s very doable with a couple of reports and a calculator. The key is the discipline to do it every month. Untimely reconciliations or skipping months can make it much more difficult down the line to identify inaccuracies and trace back errors. In short: reconcile monthly, and do the three-way check.

Investigating Differences

If during reconciliation you encounter any discrepancies, address them immediately. Common issues include: bank fees or interest not recorded (resolve by recording them properly as discussed above), a trust check that bounced or was voided (ensure it’s reflected in QBO), or perhaps a transaction recorded to the wrong client or wrong account. QuickBooks’ detailed reports can help you sleuth these out.

For instance, if the total liability is off by $100, scan the recent transactions – maybe someone recorded a $100 deposit to the wrong account (operating instead of trust) or there’s a duplicate entry. It’s much easier to fix errors if you catch them close in time. Waiting months could mean you don’t remember the transaction details. This is why a fresh monthly reconciliation habit is essential. It’s not just a compliance formality – it’s your chance to catch and correct mistakes proactively.

Reporting to Clients or Regulators

With accurate records, generating reports is simple. QuickBooks can produce a Client Ledger Report (which is basically the transaction history for a particular client’s trust sub-account) and a Trust Account Balance Report (listing each client’s balance and the total). You might not have a one-click report titled exactly that, but by customizing standard reports you can get the same information. For example, a Transaction Detail by Account for one sub-account serves as a ledger, and a Balance Sheet with the trust sub-accounts shows all balances.

If your state bar asks for a quarterly reconciliation, you can provide the bank statement, QBO reconciliation summary, and the list of client balances. Some firms also send clients an annual statement of their trust account activity (even if not required, it’s a nice transparency gesture and can double as a confirmation that your records match the client’s). In any case, QBO’s reporting capabilities – combined with a well-structured chart of accounts – will have you ready to compile whatever data you need for compliance.

At the end of each month, when you can confidently say “the trust account is balanced and every penny is accounted for,” you’ll feel a huge sense of relief. It’s one of those behind-the-scenes tasks that doesn’t directly earn revenue, but it protects your revenue (and license!).

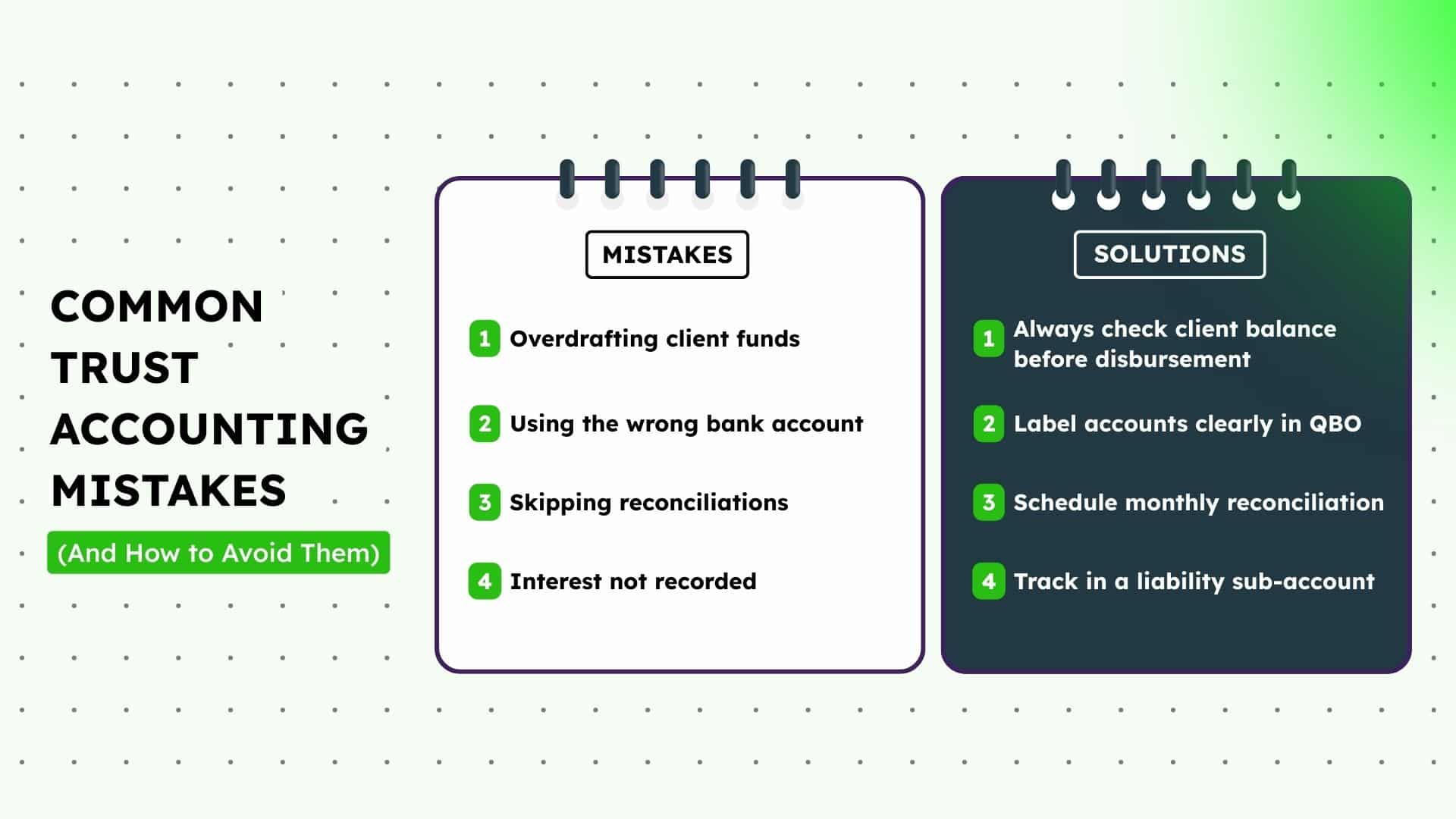

Common Challenges (and Solutions) in IOLTA Bookkeeping with QuickBooks Online

Even with a good system in place, there are a few pain points and common errors to watch out for when using QuickBooks Online for trust accounting. Being aware of these challenges will help you prevent problems before they occur:

Lack of Built-in Safeguards

QuickBooks Online is not designed exclusively for law firms, so it will not automatically prevent certain mistakes. For example, QBO will happily let you write a check that overdraws the IOLTA bank account or even makes a client sub-account go negative. It’s up to you to catch that. Specialized legal accounting software (like LeanLaw) adds safeguards – e.g., Clio will not allow applying more trust funds to an invoice than the client actually has on balance. In QBO, if you’re not careful, you could theoretically spend $5,000 from John’s sub-account when he only had $4,000 (ending up with a -$1,000 balance for John – meaning you used another client’s $1,000 inadvertently). QuickBooks won’t flag that for you in real-time.

Solution

Always check the client’s balance before approving a disbursement. You can do this by quickly glancing at the sub-account balance or running a report. Also, reconcile and review balances often. If you are using QBO alone, consider maintaining a manual ledger or using an Excel sheet as a redundant check for each client, updated with each transaction – some practitioners do this as a double-check measure. While it adds a bit of work, it can act as your alert system if something doesn’t match. The better solution might be to use an integrated tool (discussed below) that imposes those balance rules so you physically cannot overdraft a client.

Human Error in Data Entry

With multiple steps and accounts, a simple error like selecting the wrong account or client can happen. For instance, you might accidentally deposit a retainer to your Operating account in QBO instead of the IOLTA, or choose the wrong client sub-account on a deposit. These errors can throw off your balances (and potentially mean one client’s money is attributed to another). Solution.

Use a checklist or workflow for new staff or for yourself until you’re very comfortable. Double-check critical fields on each entry: the bank account (it should be IOLTA for trust transactions) and the liability account (it should be the correct client’s sub-account). Take advantage of QBO’s features: for example, you can make use of Bank Rules (if using bank feeds) to semi-automate categorizing trust deposits/withdrawals to the right accounts based on memo, but be cautious and test any rule thoroughly.

Another tip is to customize your Chart of Accounts names to make them extremely clear – e.g., prefix trust accounts with “TRUST – Client Name” so they’re easily distinguished from other accounts in selection menus. If an error does slip through, your monthly reconciliation will catch it (the numbers won’t add up), and then you can correct the entry (QBO allows editing transactions – just be careful editing past transactions if you’ve already issued reports; always maintain the audit trail).

Improper Record-Keeping / Not Tracking Details

Some law firms get in trouble because they didn’t keep individual client ledgers or documentation. If you only tracked the trust account in total, you might lose sight of whose money is whose. QBO sub-accounts solve that, but only if every transaction is labeled correctly. Another common record-keeping issue is not retaining documents or explanations for transfers.

Solution

We’ve emphasized using sub-accounts and memos – that’s the first line of defense. In addition, maintain a habit of printing or PDF-ing key reports after each big transaction (like a client ledger after a major withdrawal, showing before and after balance). It may seem excessive, but these records can be invaluable if a question arises. Also, consider storing documents (like scanned checks or deposit slips) as attachments in QuickBooks Online transactions – QBO allows you to attach files to any entry. This way, the proof is right there in your ledger if you ever need to show it.

Timing Issues & “Stale” Trust Balances

If you only update QuickBooks once in a while, your trust balances might not be current, which is risky. Say you deposit a retainer check but don’t record it in QBO until two weeks later – during that time, your books underestimate that client’s balance. If you had multiple such delays, you might mistakenly think a client has more in trust than they really do.

Solution

Enter trust transactions in QBO as soon as they occur. If you receive a retainer, record it that day (or by week’s end at latest). If you write a trust check, enter it immediately. Many firms sync their online banking with QBO; while bank feeds can help, don’t rely on them alone for trust transactions because of the potential delay. Use them as a reconciliation tool, not as the initial entry method. Prompt data entry ensures your QuickBooks balances are always up to date, which reduces the chance of an overdraft or error.

Commingling and “Slip-ups”

Sometimes the mistake is not technical but procedural – e.g., someone in the firm mistakenly deposits a settlement check into the operating account or writes a check for a client expense from the wrong account. These are bigger issues outside of QuickBooks (bank error rather than QB error), but they will show up when you reconcile (e.g., you can’t find the deposit in the trust account because it went into the wrong account).

Solution

Educate everyone involved with handling funds about the importance of using the correct bank account. Label your physical checks or online banking templates to clearly say “Trust Account” and “Operating Account” to avoid confusion. If such a mistake happens, correct it immediately: move the funds to the right account, document why, and note it in case it ever needs explanation. QuickBooks entries should then be made to reflect the correction (e.g., if a check was deposited wrong, do a transfer in QBO to fix the balances).

Volume and Complexity

As the number of clients and transactions grows, manually keeping tabs on everything becomes more labor-intensive. You might have dozens of sub-accounts and hundreds of transactions a month. Generating reports and doing the three-way reconciliation can be time-consuming if done entirely by hand, especially if any issue pops up. This is where many firms start looking for automation or software solutions to assist. QuickBooks is doing the heavy lifting on calculations, but it doesn’t provide reminders, compliance checklists, or automatic reports specific to trust accounting. The more complex your trust accounting gets, the more you might benefit from dedicated tools or integrations – which leads us to our next section.

(For more detail on common mistakes, see our article on Trust Accounting Pitfalls to Avoid which covers several real-world examples and prevention tips.)

LeanLaw Integration: Automating IOLTA Management with QuickBooks Online

If reading through the workflows above makes your head spin, you’re not alone. Many law firms find that while QuickBooks Online is a powerful accounting tool, it needs some legal-specific enhancements to make trust accounting truly efficient and foolproof. This is exactly where LeanLaw comes into play. LeanLaw is legal accounting software that tightly integrates with QuickBooks Online, effectively turning QBO into a law firm-friendly system. Here’s how LeanLaw can simplify and streamline IOLTA management:

Seamless QuickBooks Online Integration

LeanLaw was built to work hand-in-glove with QBO. All the trust transactions we described (deposits, checks, transfers) can be initiated in LeanLaw’s interface, and LeanLaw will automatically post the proper entries to QuickBooks in the background. This removes steps and reduces the chance of human error. For example, when you record a client retainer in LeanLaw, it can create the deposit in QBO to the correct IOLTA account and liability account without you having to navigate QBO menus. LeanLaw essentially acts as a legal-specific front-end for QuickBooks, with workflows optimized for lawyers. The result is faster, more accurate data entry – LeanLaw’s team boasts that what might be a “12-step trust accounting process in QuickBooks Online is now just a few clicks” with LeanLaw.

Preventing Common Errors

Remember the issue of accidentally over-drafting a client’s funds? LeanLaw’s trust accounting engine prevents that scenario entirely. It tracks each client’s trust balance and will not let you apply or withdraw more funds than available for that client. For instance, if Client A has $500 in trust and you try to allocate $600 to an invoice, LeanLaw will stop you (or only apply $500 and alert you). This kind of safeguard isn’t present in QuickBooks alone. By using LeanLaw, you add a layer of protection that ensures compliance with the fundamental rule: you can’t spend what isn’t there. Similarly, LeanLaw can automatically include the client’s current trust balance on invoices or statements, which helps meet those state requirements and keeps clients informed. These features are designed to keep you compliant with state bar rules and regulations.

Automated Three-Way Reconciliation and Reporting

One of LeanLaw’s most praised features is its ability to keep QuickBooks and your trust records in sync in real time, making reconciliations much easier. LeanLaw provides tools for a continuous three-way reconciliation – it knows the bank balance (via QBO bank feed), the QBO ledger balance, and each client’s balance, and helps ensure they are always aligned. Come reconciliation time, LeanLaw can generate reports that show all three in agreement, saving you the manual steps. In fact, LeanLaw can remind you to do the reconciliation and guide you through it, or your bookkeeper can simply verify what LeanLaw has prepared.

Additionally, LeanLaw offers on-demand client trust reports, so at any moment you can pull up a polished report of all clients’ trust balances (no need to custom-build it in QBO each time). Need to see the ledger of Client X? Two clicks in LeanLaw and it’s on your screen, pulling live data from QuickBooks. This level of automation and ease can turn a once-dreaded monthly chore into a quick review task. It’s like putting your trust accounting on “autopilot” – you maintain control and oversight, of course, but the software handles the heavy lifting.

Integration of Billing and Trust Payments

LeanLaw is not just for trust accounting; it’s a full billing and timekeeping system. The advantage here is that it connects your billing with your trust funds. Suppose you have an invoice ready to bill the client – LeanLaw will tell you if that client has sufficient trust funds, and with one action, you can apply the trust money to the invoice. LeanLaw will then signal QuickBooks to record the payment and the trust withdrawal appropriately.

No separate steps of writing checks and receiving payments; LeanLaw orchestrates it in the proper sequence behind the scenes. This not only saves time but also ensures that nothing falls through the cracks (you won’t forget to actually move the money or accidentally double-pay an invoice, for example). It’s all synchronized. Moreover, because LeanLaw is matter-centric, it provides a matter dashboard where you can see at a glance the work-in-progress, outstanding balances, and trust funds for that matter – something that would take multiple reports to gather in QuickBooks alone.

Trust Requests and Online Payments

Some modern practice management features included in LeanLaw (and similar tools) allow you to send trust payment requests to clients (for replenishment) and even let clients pay retainers online which go directly into the IOLTA. If you utilize LeanLaw’s built-in online payment integrations, when a client pays, LeanLaw can automatically record the incoming funds to trust in QuickBooks.

This level of automation ensures no delays or omissions in recording deposits – a common area where firms might slip if doing it all manually. LeanLaw essentially acts as a bridge between your client, your bank, and QuickBooks, keeping everything updated in real time.

Audit-Ready Records and Logs

LeanLaw, by virtue of integrating and focusing on trust, can produce audit-ready records. If your jurisdiction wants a specific form of report, chances are LeanLaw has a template for it. And since LeanLaw is cloud-based (just like QBO), your data and logs are securely stored and accessible. Think of it as an insurance policy – all the data is consolidated, and if you ever face an audit, you can involve your LeanLaw reports along with QBO to satisfy whatever is needed.

While QuickBooks Online is an excellent choice for trust accounting on its own when set up right, adding LeanLaw transforms the experience by reducing manual effort and tightening compliance controls. LeanLaw is purpose-built to understand the nuance of IOLTA management – from preventing overdrafts to automatically keeping client ledgers – so you don’t have to constantly worry “Did I remember to do X?” or “What if I make a mistake on Y?”.

Many law firms partner QuickBooks with LeanLaw to get the best of both worlds: world-class general ledger accounting plus legal-specific trust accounting features . The integration is smooth, meaning you don’t have to abandon QuickBooks at all; you’re enhancing it.

(If you’re interested in how LeanLaw can make trust accounting easier, check out LeanLaw’s Trust Accounting features page or schedule a demo to see it in action. LeanLaw demonstrates how tasks that used to take multiple steps in QBO alone can be done in a couple of clicks, all while maintaining compliance.)

IOLTA in QBO

Trust accounting may never be the most glamorous part of running a law firm, but it does become far more manageable when you apply the right practices and tools. QuickBooks Online, configured with a proper IOLTA chart of accounts and used diligently, provides a solid foundation for tracking client funds. By setting up separate trust accounts, recording every client transaction methodically, and reconciling like clockwork, you can stay on top of your IOLTA with confidence.

Always remember the core principles: keep client money separate, never spend more than what a client has in trust, and always keep records that prove each client’s funds are intact. We’ve seen that many common pitfalls (commingling, errors, delayed updates) can be avoided with a bit of discipline and awareness. And if manual trust accounting in QuickBooks feels overwhelming, know that you don’t have to go it alone – leveraging technology like LeanLaw can automate the complex parts and add important safeguards, so that compliance is built into your workflow.

Mastering IOLTA management is an investment in your firm’s integrity and efficiency. It protects your clients, your law license, and your peace of mind. With QuickBooks Online and possibly a helping hand from LeanLaw, you can transform trust accounting from a stress-inducing chore into a routine process that runs smoothly each month. Here’s to keeping those client funds safe, sound, and fully accounted for – your future self (and your bar auditor) will thank you!