Managing client trust accounts is a critical responsibility for law firms, yet it’s often shrouded in confusion for new attorneys. If you practice in Ohio, you must understand IOLTA (Interest on Lawyers’ Trust Accounts) and the state’s trust accounting rules. Mishandling client funds isn’t just a paperwork issue – it’s one of the top reasons lawyers face discipline, second only to neglect.

In this comprehensive guide, we’ll demystify IOLTA and trust accounting requirements in Ohio. We’ll explain what an IOLTA account is, how to avoid commingling funds, the importance of reconciliation and client ledgers, and Ohio-specific compliance rules. By the end, you’ll have a solid foundation to keep client money safe (and keep your law license safe, too).

What Is IOLTA and Why Does Ohio Require It?

IOLTA stands for “Interest on Lawyers’ Trust Accounts.” In Ohio, as in many states, lawyers are required to place client funds into a special interest-bearing trust account whenever those funds are too small in amount or held for too short a time to warrant a separate account. The interest earned on pooled IOLTA accounts does not go to the lawyer or client; instead, Ohio law directs it to the state’s legal aid fund to support access to justice. In fact, Ohio’s IOLTA program, established by the General Assembly in 1985, ensures that interest from lawyers’ trust accounts is used for charitable legal purposes via the Ohio Access to Justice Foundation.

Who needs an IOLTA? Every Ohio attorney who handles client money (whether it’s filing fees, settlement proceeds, advance fee retainers, etc.) must maintain a trust account set up as an IOLTA. If you’re part of a firm, the firm’s IOLTA can cover all lawyers in the firm. The only attorneys exempt are those who never receive or disburse client funds in Ohio. Setting up an IOLTA is done through any eligible financial institution in Ohio that participates in the program, and you must register your IOLTA with the Supreme Court of Ohio on your biennial attorney registration form. The account should be clearly titled as a client trust account or IOLTA so it’s identifiable as a fiduciary account.

How IOLTA works: Say a client gives you a $2,000 retainer for future legal fees. You deposit it into your IOLTA. The bank pools that money with other clients’ funds you’re holding, and it pays interest on the total balance. Periodically, the bank remits the interest to the state’s fund for legal aid – you or your client do not keep the interest. Meanwhile, the principal $2,000 remains safely in your trust account until you earn it by doing the work and billing the client. At that point, you’ll transfer the earned amount to your firm’s operating account (more on that process later). If the amount were large enough or held long enough to earn net interest for the client, you would instead open a separate interest-bearing trust account for that client’s benefit. But most routine client funds go into the pooled IOLTA by default.

Ohio’s Rules of Professional Conduct (Rule 1.15) govern how lawyers must handle client funds. In short, they require that client money be kept separate from the lawyer’s money, in an interest-bearing trust account in Ohio. The rule also ties in with Ohio Revised Code §§4705.09 and 4705.10, which set out the IOLTA requirements and the role of the Ohio Access to Justice Foundation. Now that we know what an IOLTA is, let’s look at the practical dos and don’ts of managing that account—starting with the cardinal rule: no commingling.

No Commingling: Keep Client Funds Separate

“Commingling” means mixing client funds with your own funds or law firm funds. Ohio law strictly prohibits commingling – client money must be segregated in the trust account, not in your personal or business accounts. When you receive money that belongs to a client (like an advance fee, settlement, or escrow), deposit it into the IOLTA and never into your general operating account. Likewise, don’t pay personal or firm expenses directly out of the trust account – that money isn’t yours until it’s earned and removed properly.

There is a narrow exception to the commingling rule: you may deposit a small amount of your own funds into the trust account solely to cover bank service charges or fees. For example, if your bank charges a $15 monthly maintenance fee on the account, you can keep a cushion of your firm’s money there to avoid dipping into client funds for those charges. Ohio’s guidance suggests this should not exceed around $100 on average. Apart from such nominal amounts for bank fees, no personal or firm money should be in the client trust account.

Keeping client funds separate isn’t just an ethical formality – it protects clients and you. If you were to deposit client money into your own account, even inadvertently, you could be seen as misappropriating those funds. The Ohio Supreme Court routinely disciplines attorneys for commingling or misusing client trust funds, even absent criminal intent. The safest approach is simple: treat the IOLTA as sacrosanct for client money only. Use it to hold unearned client funds and disburse those funds only for the client’s matter or to transfer earned fees to your firm.

Unearned vs. earned fees: Remember that most retainers and advance fee deposits are unearned when received – they belong to the client until you perform the work. Ohio Rule 1.15(c) mandates that advance legal fees and expenses be deposited into the trust account to start. You then withdraw money from the trust only when it’s earned (or when expenses are incurred) and with proper notice via an invoice or billing.

For example, if you bill $500 against that $2,000 retainer, you would transfer $500 from the IOLTA to your operating account, leaving $1,500 of the client’s funds still in trust. This ensures you’re never “borrowing” client money to run your firm. It’s essentially pay-as-you-go from the client’s perspective: their money stays in trust until you’ve earned it.

One special case in Ohio is flat fees or retainers labeled “earned upon receipt.” If you and your client agree to a non-refundable flat fee that is earned the moment it’s paid, Ohio ethics authorities say that fee is considered the lawyer’s property on receipt and thus should not go into the IOLTA. However, be very careful with this arrangement. Ohio Board of Professional Conduct Opinion 2016-1 clarifies that even when a fee is designated “earned upon receipt,” you must still refund any portion of the fee that is unearned if you do not complete the work.

In practice, unless you have a clear, written agreement that a fee is earned immediately (and it complies with all ethical requirements), the prudent approach is to treat advance fees as unearned and keep them in trust. This avoids any allegation that you took client money prematurely. When in doubt, err on the side of protecting the client’s funds.

Bottom line: Keep client money in the trust account until it’s earned or until it needs to be paid out on the client’s behalf. Do not deposit your own funds into the IOLTA (other than a tiny amount for fees), and do not use one client’s money to cover anything for another client. Ohio’s rule essentially creates a firewall between your clients’ funds and your firm’s funds – don’t breach that firewall.

Client Ledgers: Track Every Client’s Money

When you have multiple clients’ funds pooled in one IOLTA, it’s crucial to track each client’s balance separately. This is done through client ledgers. A client ledger is like an individual bank statement for each client’s portion of the trust account. Every time you receive money for that client or pay something out for that client, you record it on their ledger. Ohio’s rules explicitly require maintaining a record for each client showing all funds received, disbursed, and the current balance for that client.

For example, if Client A deposits $5,000 and later $2,000 is used to pay a settlement expense, Client A’s ledger should chronicle: “Received $5,000 on [date] – source: client deposit; Paid $2,000 on [date] – to Acme Medical (settlement expense); Current balance: $3,000.” At any given moment, you should be able to look at Client A’s ledger and know exactly how much of the trust account belongs to Client A. The same goes for Client B, Client C, and so on.

In addition to individual client ledgers, Ohio requires keeping a general ledger (account register) for the trust account itself. This register logs every transaction in and out of the trust account in chronological order, for all clients combined. It typically includes the date, amount, and a description (including which client it affected) for each deposit or withdrawal, plus a running balance for the entire account. Essentially, the general ledger is the big picture, while the client ledgers are the zoomed-in details.

Why are both needed? Because the sum of all the individual client ledger balances must equal the balance in the trust account. The general ledger’s running balance should always match the total of all clients’ funds. If your trust account has $50,000 in it, you might have, say, $30,000 attributable to Client X, $15,000 to Client Y, and $5,000 to Client Z – and those three ledgers should add up to $50,000. If they don’t, something is wrong.

Maintaining accurate ledgers prevents a host of problems. It ensures you don’t accidentally use one client’s money for another’s bills (a huge no-no). It also signals if a client’s funds are getting low or if a transaction was recorded incorrectly. Ohio Rule 1.15 requires detailed records in this fashion, and you must preserve these records for seven years after the representation ends. That means if a client’s matter concluded today, you’d need to keep their trust ledger (and related records like bank statements and cancelled checks) for seven years. This lengthy retention period is to allow audits or investigations well after the fact, if needed.

Best practices for ledgers: Keep your client ledgers updated in real time whenever money moves. Each deposit and disbursement gets recorded with the date, amount, purpose, and resulting balance. Many attorneys use legal-specific accounting software (or at least spreadsheets) to manage trust ledgers; some even leverage their accounting system (like QuickBooks with a trust accounting add-on) to automate the tracking.

The key is that you should never be guessing how much a given client has in trust. If a client asks for their trust balance or if you need to know how much is available to pay a bill, you should be able to pull up their ledger immediately and give an accurate answer.

Remember, writing a check from the trust that exceeds what that client has on deposit is effectively borrowing from other clients’ money, which is prohibited. Keeping individual ledgers with current balances helps you avoid that mistake. In short: one client’s money should never subsidize another’s. Proper ledger management is what keeps everything compartmentalized.

Monthly Reconciliation: Balancing the Trust Account

Reconciling your trust account is as important as balancing your personal checkbook – only with client funds, the stakes are much higher. Reconciliation means comparing three things each month: (1) the bank statement for the trust account, (2) your internal general ledger balance, and (3) the total of all your client ledger balances. All three should line up. Ohio requires attorneys to perform and retain a monthly reconciliation of their trust accounts, ensuring these records match up. In other words, Ohio’s Rule 1.15 compels a three-way reconciliation every month to catch any discrepancies.

Let’s break that down. When the bank statement comes in (or is available online) at the end of each month, you should:

- Check the ending balance on the bank statement against the ending balance in your trust account register (general ledger) for that date. They should be identical.

- Next, add up the balances of all individual client ledgers as of that date – that total should also equal the bank statement balance.

- If there are any outstanding checks or deposits in transit, take those into account (just like balancing a regular account). For instance, if a check you wrote on June 30 hasn’t cleared the bank yet, the bank statement will be higher than your records by that check amount – you’d note that but still ensure everything aligns once pending items clear.

Ohio’s emphasis on monthly reconciliation is to ensure mistakes or misappropriations are caught quickly. A famous Ohio disciplinary case illustrates this: an attorney’s long-time secretary stole tens of thousands of dollars from the firm’s trust account over several years. The attorney glanced at bank statements but never did a proper reconciliation comparing the ledgers to the bank balance. As a result, the theft went unnoticed until much later. The lawyer was disciplined for failing to reconcile monthly as required – a hard lesson in why this step is non-negotiable.

In practice, make it a routine: Every month, set a calendar reminder to reconcile the trust account. Ohio requires you to retain documentation of each monthly reconciliation for seven years, so keep a copy of a reconciliation report or worksheet in your records. If you use accounting software, it may generate a reconciliation report; if you do it manually, save the spreadsheets or printed logs showing you balanced the figures.

If any discrepancies are found (for example, the bank charged an unexpected fee, or there was interest added, or a transaction was recorded incorrectly), investigate and resolve them immediately. Unresolved differences in a trust account are a big red flag.

Not only is reconciliation mandated by the rules, it’s just good business. It gives you peace of mind that the account is accurate and that all client funds are where they’re supposed to be. It also helps catch bank errors or fraudulent transactions. Some Ohio lawyers even reconcile weekly or biweekly to stay on top of things, especially in high-volume practices – but monthly is the minimum standard and required by law.

If you find the idea of three-way reconciliation daunting, know that modern legal accounting tools can make this much easier (more on that later). The goal is to always be in a position to demonstrate exactly what money in trust belongs to which client and to show that no funds are missing. Regular reconciliation is how you prove that.

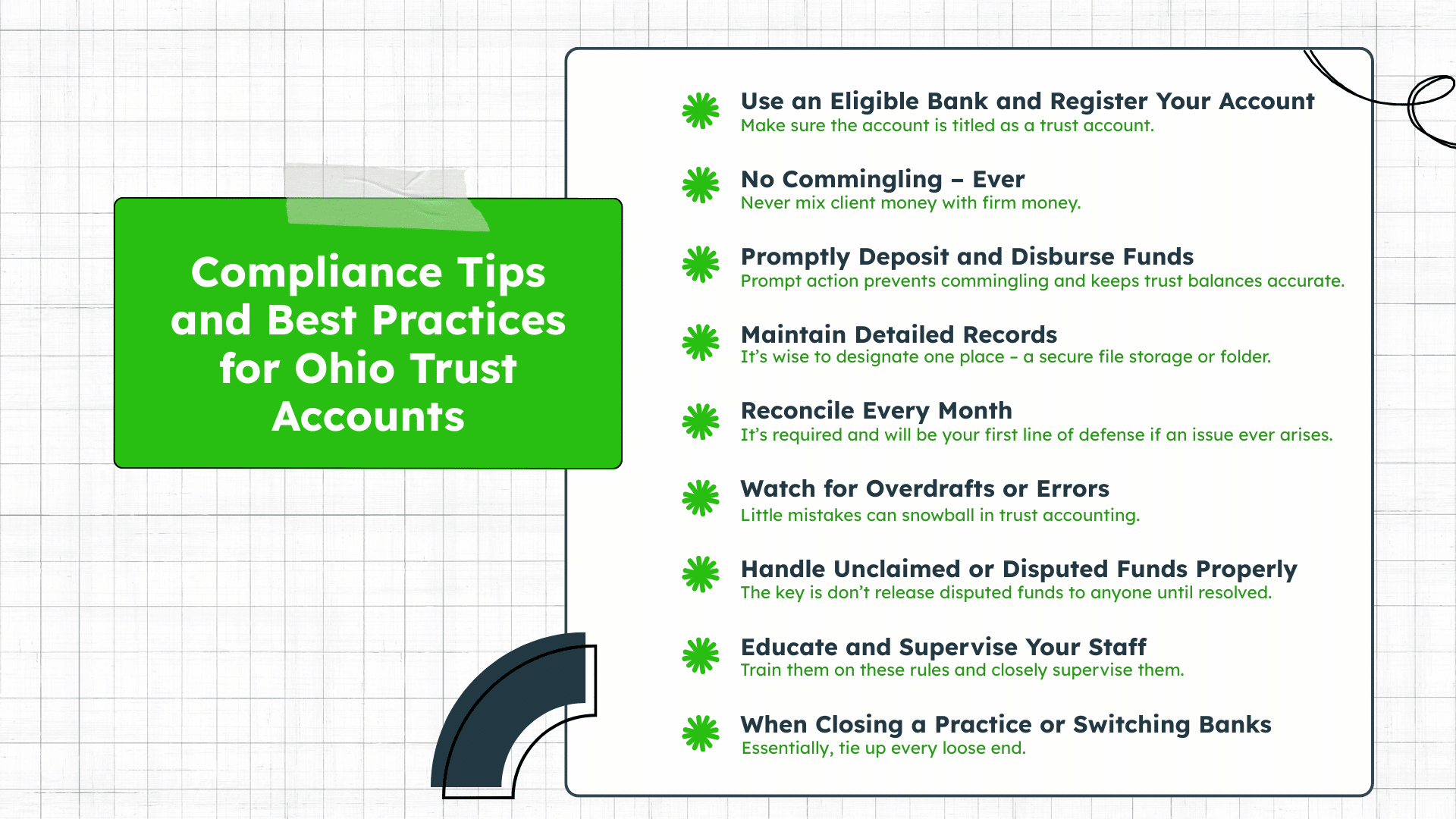

Compliance Tips and Best Practices for Ohio Trust Accounts

Ohio has some specific trust accounting requirements that every law firm should be aware of. Below is a trust account compliance checklist tailored for Ohio law practices:

Use an Eligible Bank and Register Your Account

Open your IOLTA at a bank authorized to do business in Ohio and approved for IOLTA accounts (the Ohio Access to Justice Foundation provides a list of eligible institutions). Make sure the account is titled as a trust account (e.g., “Attorney Trust Account” or “IOLTA”) so it’s clearly a client funds account. Then report that account on your biennial Ohio attorney registration. Rule 1.15 and Gov. Bar Rule VI require you to list your trust accounts when you register and update the Supreme Court if you open or close an IOLTA.

No Commingling – Ever

As discussed, never mix client money with firm money. Don’t deposit personal funds into trust except a small amount for bank fees, and don’t deposit client funds into your business account. Keep a close eye that once you earn fees and transfer them out, you don’t leave them lingering in IOLTA (that could be viewed as commingling your earned money with unearned client money). Likewise, if you must pay a bank charge or order new checks, use a bit of firm money in the IOLTA for that purpose or have the bank debit a separate account for fees – don’t take it out of client funds.

Promptly Deposit and Disburse Funds

Ohio rules state you should deposit client funds promptly into the trust account. For example, if you receive a settlement check on a client’s behalf, get it into the IOLTA right away (and ensure it clears) before making disbursements. When you have to pay the client or third parties from those funds, do so without unnecessary delay after the funds have cleared and are available.

For retainers or advance fees, deposit them to trust, then transfer out your fee promptly after you’ve earned it (typically after sending the client an invoice for services). Prompt action prevents commingling and keeps trust balances accurate. Always notify the client (usually via an invoice or statement) when you withdraw your earned fees from trust – this is part of transparency and required by ethics rules about accounting to the client.

Maintain Detailed Records

Ohio requires specific records be kept for every trust transaction. Be sure to maintain:

- A copy of every fee agreement with each client who pays you funds.

- A client ledger for each client showing all deposits, withdrawals, and the balance.

- A general ledger (checkbook register for the trust account) listing every transaction with a running balance.

- All bank statements, canceled checks, wire confirmations, and deposit slips related to the trust account.

- Monthly reconciliation reports that you perform.

Keep these records organized (many attorneys keep both digital and hard copies) and preserve them for seven years after the representation ends. It’s wise to designate one place – a secure file storage or folder – where all trust records reside, and ensure someone else in your office knows where it is in case of emergency.

Reconcile Every Month

As emphasized, do a three-way reconciliation of the trust account every month and fix any variances. Many Ohio attorneys use spreadsheets or trust accounting software to simplify this. OBLIC (Ohio Bar Liability Insurance) even provides an IOLTA reconciliation spreadsheet template for free. Regular reconciliation is not optional – it’s required and will be your first line of defense if an issue ever arises.

Watch for Overdrafts or Errors

Be extremely careful to avoid overdrawing the trust account. Banks that hold IOLTA accounts in Ohio typically must report any trust account overdraft to disciplinary authorities. Even a small, accidental overdraft (say you wrote a check thinking funds had cleared when they hadn’t yet) can trigger an inquiry. So, ensure funds are fully cleared before writing disbursement checks. Also, double-check payee information – for instance, if you have multiple client settlements, make sure each check pulls from the correct client’s balance. Little mistakes can snowball in trust accounting.

Handle Unclaimed or Disputed Funds Properly

If you have funds in trust that you can’t disperse because you can’t find the client or there’s a dispute about who owns the money, do not simply leave it indefinitely or, worse, use it. Ohio law has procedures for unclaimed funds – generally, after a certain period, unclaimed client funds should be turned over to the Ohio Division of Unclaimed Funds (with a special category for attorney unclaimed funds).

Similarly, if there’s a dispute (for example, a client and a third-party provider both claim the same funds), the rules say to keep the funds in trust until the dispute is resolved. It may eventually require interpleader or agreement between parties. The key is don’t release disputed funds to anyone until resolved, and don’t treat unclaimed funds as your own.

Educate and Supervise Your Staff

If you have staff (paralegals, bookkeepers) handling trust account transactions, train them on these rules and closely supervise them. Ultimately, the lawyer is responsible for any mistakes. Many trust account problems occur through simple oversight or staff error. Set up internal controls: for example, have two people review each trust reconciliation, or require lawyer approval for any disbursement.

Even if you delegate bookkeeping, make sure you personally review the records regularly (including those monthly reconciliations). Case law in Ohio has shown that a lawyer can be sanctioned for failing to adequately supervise a secretary who mishandled trust funds. Stay involved in your trust accounting – it’s not something you can completely hand off and “forget.”

When Closing a Practice or Switching Banks

If you close your practice, there are rules on distributing remaining trust funds to clients or successor lawyers. If you change where your IOLTA is held, update your registration with the Supreme Court and the Ohio Access to Justice Foundation. And when closing an IOLTA, work with the bank to ensure any residual interest or straggler funds are properly handled (sometimes a small amount of interest can post after closure).

Essentially, tie up every loose end. Ohio even suggests planning ahead for what happens to your trust account if you become incapacitated or die – for example, giving another trusted attorney authority to reconcile and disburse funds to the rightful owners. While that’s an extreme scenario, it shows the level of care the state expects with client money.

By following the above practices, you will meet the core trust account compliance requirements for Ohio and greatly reduce the risk of ethical violations. Now, let’s touch on how leveraging technology and good habits can make trust accounting easier.

Leverage Legal Tech for Trust Accounting and Billing

Trust accounting has a reputation for being tedious, but modern software can lighten the load. Many Ohio firms use tools like LeanLaw’s trust accounting software (integrated with QuickBooks Online) to automate record-keeping and ensure compliance. For example, LeanLaw’s trust accounting features support three-way reconciliation, automatically syncing your client ledgers, trust bank account, and accounting records in real time. This kind of tool helps prevent errors by design – it won’t let you overdraft a client’s balance, and it keeps an audit trail of every transaction.

Using legal-specific accounting software also streamlines the process of moving funds from trust to operating when earned. Because it ties into your legal billing workflows, you can generate an invoice for your fees and with a few clicks apply the client’s trust funds to pay that invoice, all while updating the ledgers accordingly. The integration between trust accounting and billing means you’re less likely to forget to withdraw earned fees (or mistakenly withdraw too much). In short, technology can enforce the rules for you, in addition to saving time.

For instance, with LeanLaw you can see a client’s trust balance right on their invoice and even allow clients to replenish trust funds online if they run low. Having that visibility encourages good communication with clients about their retainers. Plus, robust reporting tools let you quickly pull up compliance reports – handy if you ever need to show the bar your records or just to give clients a breakdown of their trust transactions.

Even if you don’t use a dedicated product, at minimum use some reliable system (even if it’s QuickBooks with a manual spreadsheet for the three-way recon). Do not rely on casual methods or memory. The stakes are too high with client money. The cost of trust accounting software is nominal compared to the risk of a mistake that could lead to client harm or disciplinary action.

Finally, cultivate a mindset of diligence. Treat trust accounting with the same seriousness you treat client confidentiality or court deadlines. Build it into your routine: for example, reconcile the trust account the same day you reconcile your operating account each month, or review trust ledgers as part of your monthly billing cycle. If you consistently follow the best practices and use tools available, trust accounting will become a manageable, even seamless, part of your firm’s workflow rather than a source of stress.

Keeping a compliant IOLTA and trust accounting system in Ohio might seem complex to beginners, but it boils down to safeguarding client funds at every step. Know the rules (Ohio provides clear guidelines), keep excellent records, and double-check your work through monthly reconciliations. By avoiding commingling, tracking each client’s money, and following Ohio’s procedures, you’ll protect your clients and stay out of ethical trouble. And remember, you don’t have to do it alone – leverage LeanLaw’s trust accounting tools and legal billing integrations to help automate compliance, so you can focus on practicing law while confidently managing your clients’ funds. With the right practices in place, you can handle trust accounts with ease and ensure your law firm meets Ohio’s trust accounting requirements every time.