Texas is known for doing everything bigger and better, and the practice of law is no exception.

But if you are an attorney or law firm administrator in the great Lone Star state, there is a very good chance there are a few accounting needs that may have you a bit stumped.

One such need is the establishment of an IOLTA account in order to manage your client funds.

What is An IOLTA Account?

IOLTA stands for Interest on Lawyers Trust Accounts and is an account that is set up at a financial or banking institution, oftentimes the same one a law firm already uses for their other banking needs.

These types of trust accounts serve as client trust accounts, and such an account is necessary when a client’s retainer is not large enough to need to be held in its own separate account.

For example, if a client’s retainer is small enough that the fees associated with opening a separate account would be more than any interest earned would be, then that client’s money will be deposited into an already-established IOLTA account that has been set up at that financial institution in the law firm’s name.

An IOLTA account is still an interest bearing trust account (just like other client trust accounts that are established at that financial institution) but what happens with the interest earned is very different.

Any interest earned on client trust funds that are held in client-specific accounts, will be credited back to that particular client.

On the other hand, any interest earned on a law firm’s IOLTA bank account will be pooled and forwarded by the IOLTA accounts fiduciary to the state’s IOLTA board for distribution through the state’s IOLTA program.

What Is a Texas IOLTA Account?

In 1981, Florida became the first state to introduce an IOLTA program and since then, each of the fifty states have adopted some version of an IOLTA program as well.

Some states have IOLTA programs that are mandated, usually by the state bar association.

Other states have IOLTA programs that are done on a volunteer basis.

In Texas, the Texas Access to Justice Program (TAJP) is a nonprofit organization that is responsible for administering the IOLTA funds that the state receives from all the various IOLTA client trust accounts from each financial institution across the state.

The Texas Access to Justice Program will then use these client funds for a variety of purposes, from providing free legal assistance in civil matters to those who need financial support, to protecting domestic violence victims and distributing grants to organizations with the resources to help them.

Clearly, the establishment of IOLTA programs and the rules governing them have been a great benefit to states like Texas.

Schedule a demo

State IOLTA programs are one of the best ways that a state can ensure legal services are being delivered to their underrepresented population.

By being able to take the nominal amounts of interest earned on every law firm’s client funds and pool them together to establish something substantial, each state now has a worthy and well-executed resource for supporting a large variety of legal services that are needed, necessary and specific to their individual state.

What are the Drawbacks of an IOLTA Account?

Though the benefits are clearly great for each individual state, there can be one big drawback as well.

All states handle client trust funds a bit differently, but there are a few rules that are unvarying, regardless of the state’s regulations on IOLTA checking accounts.

One such rule is this: under no circumstances should any monies be withdrawn from a law firm’s IOLTA account unless they are being distributed properly.

A law firm can not use client funds that have not yet been earned to pay for any operating expenses, regardless of how small, or how quickly a firm believes they could reimburse the IOLTA account for the money used.

Using client trust account funds that have not been earned to pay for any operating costs can have dire consequences for an attorney or law firm, regardless of whether there was intentional misconduct or whether it was just a lack of understanding or a mistake in the accounting system.

These consequences can range from an attorney or their law firm being fined and potentially even face disbarment.

At the very least, you and your firm will have to admit that you were engaging in careless or disorganized accounting practices — not something any lawyer or law firm wants to be associated with.

How Can I Properly Manage My IOLTA Account?

If you are looking for a way to properly manage your Texas IOLTA Account, look no further than the experts at LeanLaw to help you make this process simple, streamlined and stress-free.

LeanLaw is accounting software that is designed for and by attorneys through the United States. As professionals who have been part of the legal system for years, our team knows how to create products that will produce more accuracy as well as more transparency for your clients, your accounts and your firm as a whole.

Schedule a demo

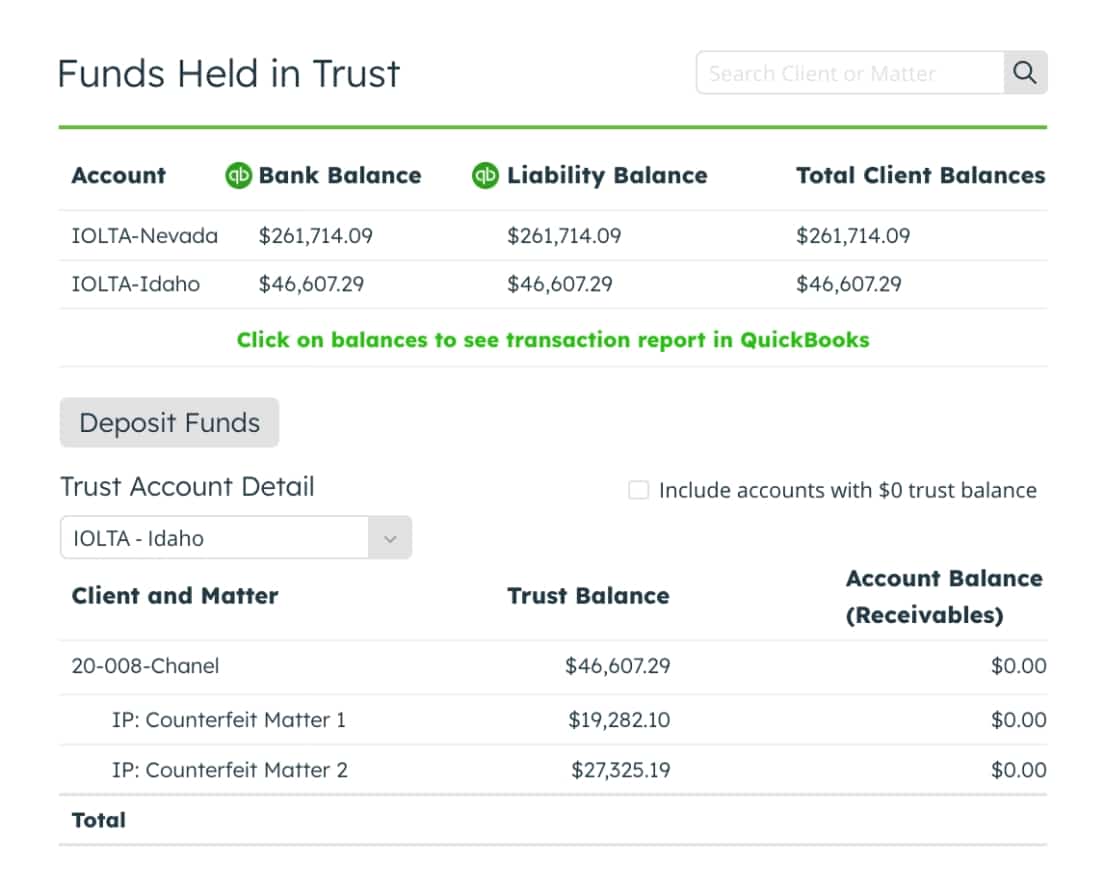

Even better, thanks to our cloud-based, native QuickBooks integration, engaging in weekly or monthly three-way reconciliation is never going to be a burden for your accounting department.

Not only will you be able to keep track of all of your firm’s banking accounts electronically, but you will also be able to better understand how funds are flowing in between all of your various trust accounts, other bank accounts and even to the state’s IOLTA program as well.

If you are ready to learn more about what LeanLaw’s experienced team and innovative software can do for you, reach out for a contact us today for a free demo and we will show you exactly what LeanLaw can do for you!