There are few things more important to a lawyer than gaining a client’s trust.

And there are few things more important to a client than trusting their lawyer with their money.

Trust accounting is a critical aspect of a lawyer’s professional responsibility, as it involves managing client funds with the utmost care and accuracy.

Lawyers have a fiduciary duty to safeguard client assets, and any mishandling or errors in trust accounting can have severe consequences, including ethical violations and potential legal repercussions.

Key Takeaways

- Managing client funds is most likely going to be a part of every law firm’s practice, and knowing how to do that well is going to be a part of every firm’s success.

- Not only are there ethical obligations when it comes to managing client funds, but there are also strict rules and regulations in place for client fund accounts that each firm must be aware of and adhere to.

- Not only can mismanagement of client funds cause a lawyer or law firm to face severe penalties and consequences, but it is also the number one way to lose a client and damage a firm’s overall reputation.

Lawyers have a fiduciary duty to safeguard client assets, and any mishandling or errors in trust accounting legal services can have severe consequences, including ethical violations and potential legal repercussions.

To enhance trust and instill confidence in clients, lawyers must adopt effective trust accounting strategies that promote transparency, accuracy, and compliance.

Strong Client Trust Accounting: 7 Strategies to Consider

Let’s look at some of the best trust accounting strategies that lawyers can implement into their practices to ensure the highest level of trust and confidence from their clients.

#1: Implement the most robust trust accounting software available:

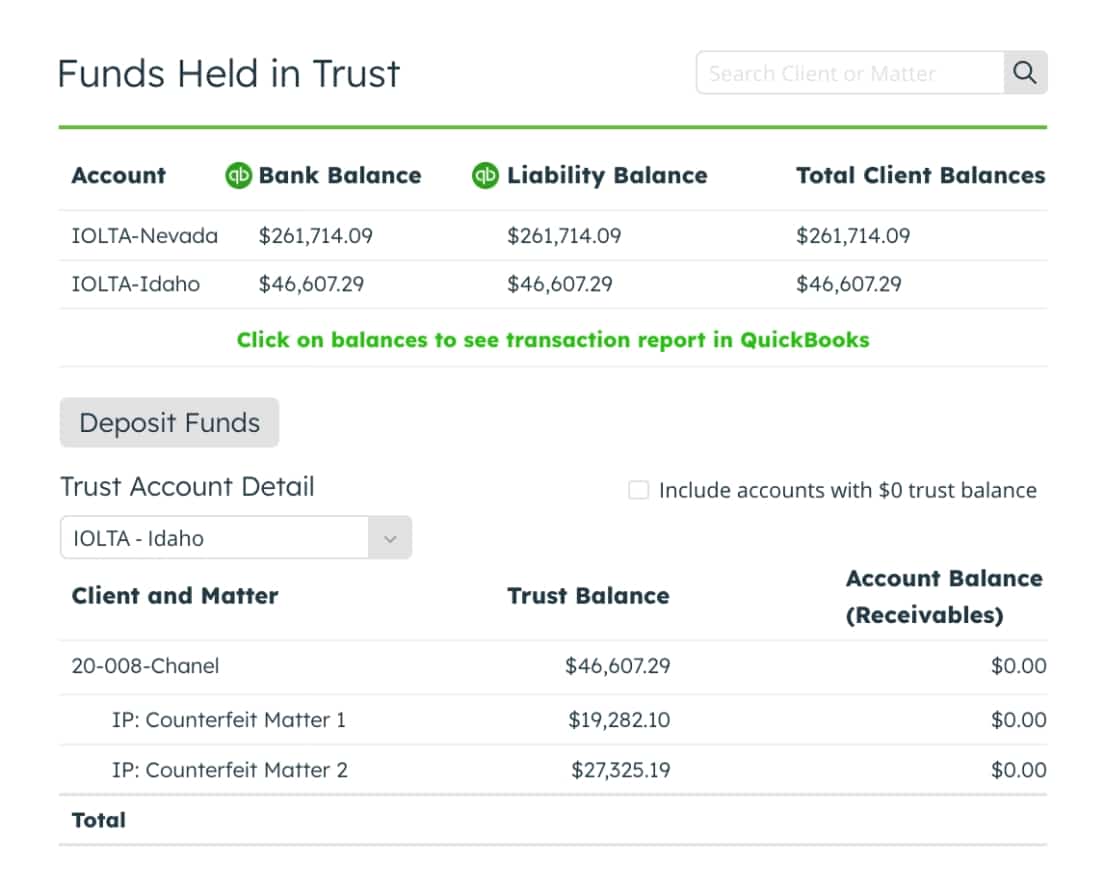

Utilizing trust accounting software specifically designed for law firms is essential for accurate and efficient management of client funds.

Such software will not only automate various trust accounting tasks – including tracking client transactions, generating detailed reports, and reconciling trust accounts – but it will also serve to make sure that your firm is in compliance with your state’s rules and regulations that govern client trust accounts.

Reputable and reliable legal trust accounting software will give both you and your clients the necessary peace of mind that everything is being handled with the utmost accuracy and professional conduct.

Leading trust accounting software, like LeanLaw, has been an industry leader in providing comprehensive features tailored to the specific needs of lawyers, which ultimately ensures compliance with trust accounting regulations and makes sure that your client’s funds are always being handles appropriately.

#2: Always maintain separate trust accounts

One crucial strategy in client trust accounting is that a client’s money must always be placed into the client’s trust account and never into the business account.

This segregation prevents the commingling of any funds, which then ensures that each client’s assets are kept separate from the lawyer’s personal or business bank account.

Some clients may have a separate account from other clients if they are a large enough entity or client. Other client’s funds may be placed into a trust account together if the amounts deposited are small or if the client plans to only be with your firm for a short period.

But in either case, under no circumstances should funds belonging to a client ever be placed into an attorney or a law firm’s account. Client funds held for any purpose should always be held for the client’s behalf in a client trust account.

#3: Reconciliation of trust accounts should happen regularly

Regular reconciliation of all client trust accounts is a vital step in order to ensure accuracy in the trust account balance and detect any discrepancies or errors.

Lawyers should reconcile trust accounts on a monthly basis, comparing the account balance with the ledger, bank statements, and client records.

This three-way reconciliation process helps identify any inconsistencies, such as missing funds, errors made or unrecorded transactions, and allows for timely corrections, thus adding to a client’s confidence in the firm that is holding their money and doing business on their behalf.

#4: Accurate and detailed record-keeping should always be a priority

Maintaining accurate and detailed records is a cornerstone of all types of workflow tasks in a law firm but it is vital for effective trust accounting to happen.

Schedule a demo

Lawyers should document all client transactions, including deposits, disbursements, fees, and any related expenses that happen to a client trust account.

Each entry should include specific information, such as the client’s name, date, purpose of the transaction, and any supporting documentation. Well-organized and comprehensive records serve as evidence of compliance and can facilitate audits or inquiries.

For the modern law firm, having a strong legal billing and accounting software system can go a long way in ensuring that detailed record-keeping happens and that errors and/or discrepancies are caught early.

Not only that, but strong legal billing and accounting software can also prove to be vital if and when a law firm’s competence or integrity is ever questioned by either a client or a governing body.

#5: Make sure to conduct regular internal reviews and audits

Internal reviews and audits will also play a vital role in ensuring trust accounting compliance.

Lawyers should periodically review their trust accounting procedures and perform their own audits to identify any potential weaknesses or areas for improvement.

This proactive approach helps address issues before they escalate and ensures ongoing adherence to trust accounting regulations.

6. Transparent communication with clients will go a long way in keeping misunderstandings at bay

Maintaining open and transparent communication with clients regarding their trust accounts is crucial to building trust and confidence.

Lawyers should provide regular updates on the status of the trust account, including any remaining balances, recent transactions, and any fees that may have been charged.

Clear and understandable statements should be provided on each client trust account, enabling clients to then review their account activity and address any concerns promptly.

Don’t wait for a problem to arise before you communicate with a client. Make sure they understand how and where their client funds are being held and educate them on how exactly lawyer trust accounts work so there are no surprises, disappointments or concerns later down the road.

#7: Invest in ongoing education and training for anyone in your firm who deals with trust accounting protocol

It’s a known fact in the legal industry that rust accounting rules and regulations can vary by jurisdiction and often evolve over time.

It is essential for lawyers and their staff involved in trust accounting to stay updated with the latest legal requirements and best practices.

Participating in trust accounting training programs, attending industry seminars, and staying informed through professional associations can enhance knowledge and ensure compliance.

It’s also a great idea to stay abreast of any changes in legal trust account software that is new to the market and make sure that the platforms you are running are as effective as they could be.

Trust accounting is a fundamental aspect of a lawyer’s ethical and professional responsibilities. By making sure to implement and invest in effective trust accounting strategies, lawyers will be able to greatly enhance trust and confidence among their clients.

What Questions do I Need to Ask When Considering Legal Trust Accounting Software?

If you are thinking about implementing new legal trust accounting software into your law firm, it’s crucial to ask the right questions beforehand to ensure you choose a system that’s going to meet your needs.

Even if you already have working trust account software as part of your practice management system, taking stock of what you have will help you determine if there are new advances or other software systems that would better meet your needs.

You know that trust accounting plays a vital role in your law firm’s tech stack.

But knowing for sure that the legal trust accounting software you are using or considering is really the best will help put your mind at ease and guarantee that you are easing the mind’s of your valued clients as well.

Let’s look at some of the questions you will want to ask legal accounting software vendors before deciding what type of client trust account software you want to implement into your practice’s tech stack.

Question 1: What are the key features of the software?

Legal trust accounting software should have features such as automated transaction recording, trust fund tracking, compliance reporting, and three-way reconciliation and integration with general accounting software like QuickBooks Online.

Question 2: Does the software ensure compliance with trust accounting regulations?

The software should have built-in safeguards and controls to help law firms comply with trust accounting rules, including accurate record-keeping, clear tracking of client funds, and the ability to perform and generate trust account reconciliations.

Question 3: Can the software generate detailed reports?

Any trust accounting software you are considering should offer robust reporting capabilities, including client ledger reports, bank reconciliation reports, and audit trails, in order to provide you with a clear overview of trust account activity.

Question 4: Does the software integrate with other essential tools?

Look for trust accounting legal software that seamlessly integrates with your existing legal practice management software, general accounting software, and other tools you use for billing and invoicing. Your trust accounting software should add to your tech stack, not detract from it.

Question 5: Is the software user-friendly and intuitive?

The software should have an intuitive interface that is easy for anyone using it to navigate and understand. It should offer a user-friendly experience for recording transactions, managing trust accounts, and generating reports.

Question 6: How secure is the software?

Trust accounting software must prioritize data security and provide features such as user access controls, data encryption, and regular backups to protect sensitive client information and to keep your client’s information safe and their trust in you high.

Question 7: What is the pricing structure?

Consider the cost of the software, including any upfront fees, subscription plans, or additional charges. Determine whether it offers the right value for the money you will spend based on the features and benefits it provides.

Question 8: Does the software offer training and support?

Check to see if the accounting software vendor provides onboarding services, training resources, ongoing tutorials, and easily accessible customer support to help you and your team effectively use the software and address any issues or questions that may arise. It’s also important to find out how updates and improvements to the software are introduced and integrated into the existing system.

Remember that the right trust accounting software is going to make a big difference in how confident your client’s feel in your ability to safeguard their funds as well as act as a good steward on their behalf.

Taking the time to carefully research and choose a trust accounting software solution that aligns with your law firm’s requirements for accurate and efficient trust accounting management is going to be well worth the effort you put into it.

For Total Trust and Confidence, Choose LeanLaw

When it comes to legal trust accounting for law firms, LeanLaw stands out as a top choice.

LeanLaw was born from the idea that if lawyers are unshackled from the excessive overhead burden of traditional legal practice management, they will be happier and better able to run a firm on their terms that truly serves their clients and society.

Schedule a demo

Today, LeanLaw has changed the way law firms look at their practice management systems and have helped lawyers take back their time and use it in areas that matter to them, while also helping firms to run more effectively and efficiently with less time and more accuracy.

Better for the lawyers. Better for their staff. And definitely better for the clients they serve.

If you’re ready to see what LeanLaw’s billing and trust accounting software can do for your practice and clients, try a free demo today.

LeanLaw is ready to give you back your time and increase the client trust you’ve worked hard to secure for your law firm.