In a world where it seems that just about everything is being made easier with the right technology, legal accounting for law firms is no exception.

The advancements in legal accounting software over the past few years have brought numerous benefits to law firms, transforming their financial management processes and optimizing overall efficiency.

One of the key advantages to enhanced legal accounting software is the automation of repetitive and time-consuming tasks, such as data entry, invoicing, and financial reporting.

This automation not only saves valuable time but also minimizes the risk of errors, ensuring accurate and reliable financial records.

Additionally, modern legal accounting software offers real-time financial visibility, allowing law firms to access up-to-date information on matters, clients, and accounts with just a few clicks.

Key Takeaways

- Strong and accurate legal accounting is crucial to a law firm’s success, but it can also be overwhelming for attorneys who don’t come from an accounting and/or billing background.

- Having the right legal accounting software integrated into your tech stack can make a huge difference in how your trust accounts are managed.

- From increased communication with clients to less frustration for your staff, the right legal trust accounting software has lots of other benefits as well.

One of the most important aspects of legal accounting software for any firm is its trust accounting practices.

This is another area where good legal accounting and billing software has revolutionized the way law firms manage their financial processes, since the right trust accounting software can offer a wide range of benefits, from streamlining operations, ensuring compliance, and enhancing financial transparency.

Are you still not sure if your law firm needs accounting software that is specific to trust accounting?

Let’s look at some of the biggest benefits that the right trust accounting software can bring to your practice, your clients and your firm’s overall success.

Why is Trust Accounting Software Better than Manual Methods?

Trust accounting software offers numerous advantages over manual methods when it comes to managing trust accounts for law firms.

Why is this the case?

Before companies like LeanLaw began designing legal accounting software that addressed trust accounting needs, law firms had to resort to outdated and inefficient methods of managing their trust accounts.

One common approach was to rely on manual spreadsheets or generic accounting software that didn’t cater specifically to the complexities of trust accounting. This often led to a myriad of challenges and risks for law firms.

Any law firm that deals with client funds is going to be held to a high standard of rules and regulations when it comes to how those client funds are to be handled and safeguarded.

Trust accounting software plays a crucial role in ensuring compliance with these standards by providing the necessary features that align with legal and ethical requirements…features that manual methods struggle with.

Human error is a part of everyday life and no one is surprised that it’s going to happen from time to time.

But, when it comes to trust accounting and client’s money, removing as much error as possible is inherently important to your firm’s success, your client’s trust and your firm’s ability to stay in compliance with the various rules and regulations that govern it in your area.

And this is where good trust accounting software can come in.

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookThe Benefits of Trust Accounting Software for Your Law Firm

In the modern legal landscape, trust accounting software has emerged as a game-changer for law firms seeking efficient and compliant financial management.

With the ever-increasing importance of trust account management, let’s look at the 5 biggest benefits that trust accounting software will bring to your law firm.

1. Enhanced Accuracy and Efficiency:

Trust accounting software will quickly automate and streamline many of your firm’s legal trust accounting basics, which will in turn reduce manual errors and improve your trust account management’s overall accuracy.

With features such as automated data entry, transaction categorization, and thee-way bank reconciliation, trust accounting software eliminates time-consuming manual processes, which will then allow law firms to focus on other core legal activities.

By leveraging technology, trust accounting software boosts a firm’s efficiency and productivity, ensuring that financial records are always up-to-date and error-free.

2. Excellent Compliance Management:

Trust accounting software provides a reliable framework for maintaining compliance with legal and ethical standards for a firm’s specific jurisdiction.

The right trust accounting software can incorporate built-in safeguards and features that align with the rules and regulations that apply to trust accounting in your area, reducing the risk of your client’s trust accounts being out of compliance and the possibility that your firm may face legal consequences – and/or loss of clients – as a result.

Trust accounting software helps law firms adhere to strict guidelines, such as maintaining separate client trust accounts, preventing commingling of funds, and generating accurate reports required for audits and inspections.

By automating the compliance processes, trust accounting software mitigates the chances of costly legal and ethical violations for your firm, keeps your reputation for good compliance practices strong and secures your firm’s long term success rate.

3. Streamlined Financial Reporting:

Trust accounting software offers powerful reporting capabilities, allowing law firms to generate comprehensive financial reports with ease.

These reports provide valuable insights into matter balances, IOLTA funds, client funds, deposit and withdrawal transactions, and other critical financial information.

By having access to accurate and detailed reports, law firms can analyze financial data, identify trends, and make informed decisions to improve financial performance.

Streamlined financial reporting also simplifies the auditing process, saving valuable time and resources.

4. Real-Time Financial Visibility:

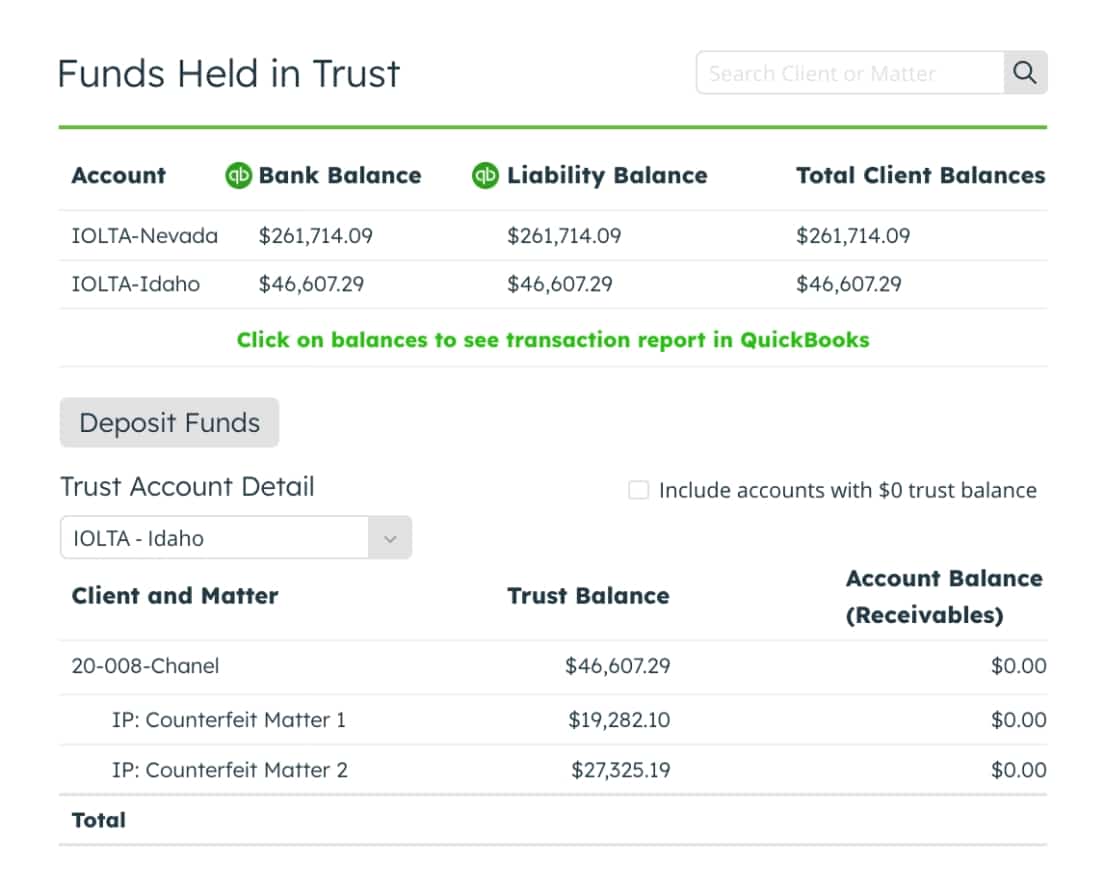

Good trust accounting software provides law firms with real-time visibility into their financial status.

It allows users to monitor trust account balances, track incoming and outgoing funds, and view transaction history instantly.

This level of transparency empowers law firms to make proactive financial decisions for their firm and their clients, identify a potential issue early on, find errors as soon as they happen, and ensure that client funds are properly managed.

Real-time financial visibility enables timely interventions and facilitates effective cash flow management, leading to improved financial stability and trustworthiness.

5. Secure Data Management:

Trust accounting software prioritizes data security, ensuring that sensitive financial information is protected from unauthorized access or breaches.

Having the right trust accounting software means that your firm can employ advanced security measures, including data encryption, user access controls, and secure cloud storage, to safeguard client data and maintain confidentiality.

By using trust accounting software, law firms can have peace of mind knowing that client funds and financial records are protected from potential threats.

How LeanLaw’s Accounting and Billing Software Can Meet Your Firm’s Trust Accounting Needs

It’s clear that trust accounting software has become an indispensable tool for law firms, offering a wide range of benefits that streamline trust accounting processes, ensure compliance, and enhance financial transparency.

From enhanced accuracy and efficiency to robust compliance management, streamlined financial reporting, real-time financial visibility, and secure data management, the advantages of trust accounting software are significant.

By adopting the right trust accounting software, your firm can optimize its financial operations, maintain the integrity of client funds, and stay ahead in an increasingly competitive legal landscape. Investing in trust accounting software is a strategic decision that not only improves financial management but also enhances the overall reputation and trustworthiness of the firm.

LeanLaw is a billing and accounting software company that was founded by legal professionals for legal professionals.

Schedule a demo

LeanLaw sets the industry standard for trust accounting software.

It’s easy-to-understand features, seamless integration with QuickBooks Online, matter-based accounting approach, compliance and audit trail capabilities, user-friendly interface, and dedicated customer support means that your firm will rest easy, knowing that LeanLaw has all your trust accounting needs met.

If you would like to learn more about what LeanLaw can do for your law firm, reach out today for a free demo and chance to talk to one of the knowledgeable experts on the LeanLaw team.