In the world of today’s legal practice, attorneys hold a greater responsibility than ever to be accurate and compliant when it comes to managing client funds.

And even though you most likely know that correct trust accounting is important, it’s vital that every attorney knows that it’s even more than that.

Key Takeaways

- Trust accounting is a vital part of a law firm’s operations, but the complexities associated with it can be confusing and result in a firm facing severe consequences if not handled correctly.

- Knowing the best practices and some key principles when it comes to a firm’s trust accounts will be vital to its overall success.

- Having the right legal accounting software integrated into your tech stack can make a huge difference in how your trust accounts are managed and ensure that your firm will never have to worry about trust accounting compliance issues or errors going unresolved.

Trust accounting is a critical aspect of the legal profession as it ensures the proper handling and protection of client funds held in trust at any law firm.

But navigating the complexities of trust accounting can be challenging, and even the most experienced lawyers can often benefit from spending some time refreshing their understanding of it.

It can never hurt to spend some time reviewing the fundamental principles involved in trust accounting in order to make sure your lawyer trust accounts are operating as accurately and as transparently as possible.

Whether you’re a seasoned practitioner or a brand new attorney, reviewing some of the most important principles of client trust accounts will serve as a valuable reminder to help you maintain compliance, protect client funds, and uphold the highest standards of professional integrity.

Handling Your Client’s Fund: 10 Principles to Keep in Mind

Trust accounts and client money can be very tricky parts of practicing law.

But – by adhering to certain principles – you can protect client funds while also upholding the highest standards of professional conduct.

Here are 10 key principles to keep in mind that can help you make sure you’re on the right path:

Segregation of Client Funds: One of the most basic and important rules that every law practice should immediately put into place is making sure that any and every client and business bank account (as well as personal account) are completely separate from each other.

Keeping client funds in a trust account that never is associated with your firm’s operating funds account is key. Many attorneys and law practices will keep their various client’s funds in a pooled trust account. For larger clients, you may want to place their funds in a separate account. But regardless of how you choose to set up your various bank accounts and manage your various client funds, maintaining separate trust bank accounts for your business account and your client trust accounts is vital.

Accurate Record-Keeping: You will always want to maintain detailed and accurate records of all your client trust account transactions, including any deposits that are made into them, any disbursements that come out, and interest earned on client funds. Having good attorney trust account software that is specifically geared toward trust accounting will make a big difference in how easy this process is.

Regular Reconciliation: Law firms that get and stay in the habit of reconciling their trust account bank statements regularly will ensure accuracy and be able to address any discrepancies as soon as they happen. Once again, a law firm that has integrated legal trust accounting software into their tech stack will find this process way less arduous and much more straightforward. Look for trust account software that has three way reconciliation — this means that your firm’s bank accounts, trust accounts and accounting software (like QuickBooks Online) will be in continuous sync with one another and always in-line with state bar association standards. With the right trust accounting software, your firm will never worry about trust accounting compliance issues or errors being unresolved and you will be well positioned for your weekly or monthly three-way reconciliation.

Trust Account Security: Banking security should always be a priority for any law firm, but it’s a professional responsibility to prioritize making sure you have implemented appropriate security measures to safeguard the client funds with which your firm has been entrusted.

Restricting certain access to trust accounts, using strong passwords and encryption, and other security protocols will go a long way in protecting your client’s trust accounts and any electronic trust account information associated with them.

Compliance with Legal and Ethical Rules: Making sure that you’re staying informed about the rules and regulations governing trust accounting for lawyers in your jurisdiction is another of the top principals when it comes to best practices for trust accounting. Again, good trust accounting software will help make it much easier to adhere to the legal and ethical obligations related to client funds and trust accounting.

Prompt Disbursement of Funds: It’s important to not always disburse client funds promptly and in accordance with client instructions, but to also disperse any interest earned in accordance with your state’s IOLTA program. IOLTA accounts must be managed carefully and your trust accounting software can be customized to help you keep any interest bearing client checking account in accordance with state rules and regulations. Always make sure you are obtaining the proper authorization, maintaining a transparent process for fund disbursement, and keeping accurate records when any funds are being disbursed, regardless of where they may be moving to.

Schedule a demo

Prompt Resolution of Discrepancies: Any discrepancies or errors identified in the trust accounting records should be promptly investigated and resolved. This includes addressing discrepancies in a timely manner, documenting the steps taken to resolve them, and notifying the affected parties, such as clients or the appropriate regulatory authorities, if necessary. Prompt resolution of discrepancies helps maintain the accuracy and integrity of trust accounting records, ensuring transparency and trust in the attorney-client relationship.

Prohibition of Unauthorized Use: Though it may sound obvious, it’s important to remember that any money held in a client’s trust account should never be used for personal or business expenses. Lawyers have found themselves dealing with severe consequences as a result of borrowing from a trust account or using client funds for purposes unrelated to the client’s matter.

Regular Auditing and Reviews: Conducting internal audits or engaging independent auditors to review your trust accounting practices will make sure that accurate and detailed records are always being kept and are in line with your state’s bar association requirements. Regularly review processes and procedures, and implement appropriate controls to mitigate the risk of errors or fraudulent activities.

Continuing Education and Professional Development: Attorneys and staff who stay updated with any new changes in attorney trust accounting rules, regulations, and best practices will reap the rewards of having clean and clear accounting in place. Take some time to attend relevant seminars, workshops, or courses to enhance your knowledge and skills in trust accounting and regularly reassess your current trust accounting software to make sure it’s the best system for your law firm. Find software that lets you practice law without worrying about whether or not your client and business accounts are all in compliance and operating as efficiently and effectively as possible.

By adhering to these 10 principles, attorneys can ensure compliance with legal and ethical requirements, protect their clients money, and maintain their strong reputation in their community and industry as a whole.

Trust accounting is not only a legal obligation but also a reflection of your commitment to your clients and the integrity of your law firm. Upholding these principles will contribute to building trust and confidence with your clients while safeguarding their financial interests.

LeanLaw: The Industry Leader in Trust Account Software

As the industry standard for trust accounting software, LeanLaw offers law firms a powerful and comprehensive solution to effectively manage their trust accounts (as well many other aspects of their billing and accounting software needs.)

Want to know why LeanLaw has this coveted title?

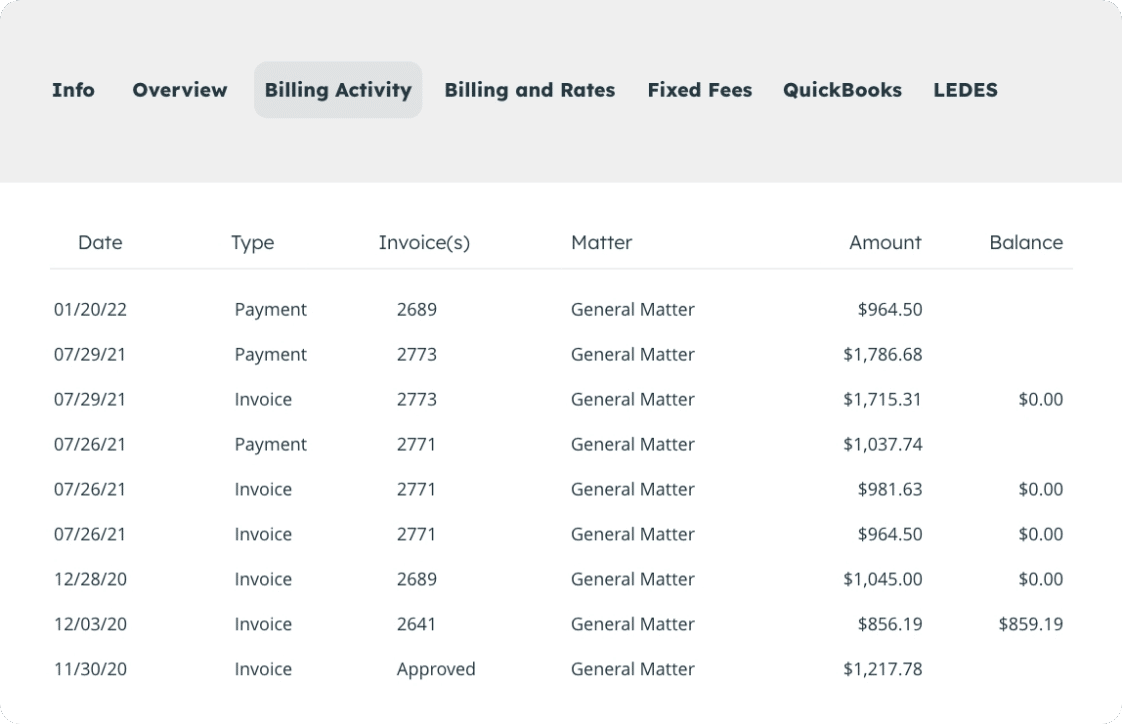

1. Robust Trust Accounting Features: LeanLaw provides a wide range of trust accounting features specifically designed for law firms. It offers complete visibility and control over client funds, allowing law firms to track deposits, disbursements, and transfers with ease. The software ensures compliance with trust accounting rules and regulations, minimizing the risk of errors and potential legal consequences.

2. Seamless Integration with QuickBooks Online: LeanLaw seamlessly integrates with QuickBooks Online, enhancing its trust accounting capabilities. The integration allows for real-time synchronization of financial data, streamlining the trust accounting process and eliminating the need for manual data entry. Law firms can easily combine the familiarity and power of QuickBooks Online while also benefiting from LeanLaw’s specialized trust accounting abilities.

3. Matter-Based Accounting: LeanLaw’s matter-based accounting approach simplifies trust accounting for law firms. It allows firms to associate trust transactions with specific matters or clients, ensuring accurate tracking and reporting of trust activity for each case.

4. Compliance and Audit Trail: LeanLaw is designed for ultimate compliance with a law firm’s specific governing rules and regulations and offers an extensive audit trail to ensure transparency and accountability in trust accounting. This software automatically logs every trust transaction, creating a detailed record of all activities.

5. User-Friendly Interface: LeanLaw is known for its user-friendly interface, making it easy for a law firm’s staff to navigate and utilize the software effectively. The intuitive design and clear workflows simplifies all trust accounting tasks, which then greatly reduces the learning curve and enables efficient adoption by the entire team. LeanLaw’s user-friendly approach enhances productivity and minimizes errors.

6. Dedicated Customer Support: LeanLaw is committed to providing exceptional customer support to its users. Law firms can rely on LeanLaw’s knowledgeable support team for assistance with any trust accounting-related inquiries or issues. This type of support guarantees that law firms have the guidance and assistance they need to effectively manage their trust accounts.

As a company that was founded by legal professionals for legal professionals, LeanLaw sets the industry standard for trust accounting software.

Its robust features, seamless integration with QuickBooks Online, matter-based accounting approach, compliance and audit trail capabilities, user-friendly interface, and dedicated customer support means that your firm will rest easy, knowing that LeanLaw has all your trust accounting needs met.

If you would like to learn more about what LeanLaw can do for your law firm, reach out today for a free demo and chance to talk to one of the knowledgeable experts on the LeanLaw team.