You’ve mastered the often-tedious task of making sure you’re billing your clients appropriately.

Your billable hours all add up and you’ve accurately accounted for any expenses you’ve incurred since the last billing cycle.

Everything is set and ready to go.

But one problem remains.

Just because you’ve done your due diligence of making sure your billable hours and expense tracking are all correct doesn’t mean your client is going to pay you in the time period you’ve both agreed on.

Is there a way that your legal billing software can help you get paid faster while making the whole billing process easier on you, your accounting staff and your clients?

Key Takeaways

- Accurate and timely invoices are a crucial part of a law firm’s success.

- Time spent trying to hunt down unpaid or overdue invoices can be a huge drain on a law firm’s resources and hours that are staff (that are already limited.)

- Having a billing and accounting software system that prioritizes strong client invoicing ensures that law firms can maintain a healthy cash flow and build strong client relationships.

In the fast-paced world of legal practice, all legal professionals know that time is our most valuable asset and it’s often limited.

And because of this, efficient billing and payment processes are crucial for the financial success of any law firm.

Tracking billable hours and expenses accurately is vital, but ensuring timely payments from clients can be equally important…and challenging.

Whether it’s due to a lack of immediate funds or just forgetfulness, a client’s delayed payment can post a whole host of problems, from slowing down a case to causing your firm to have financial issues of its own.

Not only that, but let’s be honest. Chasing a client for funds is not fun. And doesn’t help with the relationship either.

This is where the right legal billing software can be a real game-changer.

By implementing robust billing software, law firms can revolutionize their payment collection process, which will not only accelerate payments and enhance the firm’s cash flow.

And hopefully keep your client relationship on good terms!

The right legal billing software will have certain key features that will make a big difference in streamlining your billing process and helping you get paid faster.

From online payment options and automated reminders to real-time payment tracking and customizable invoices, we’ll examine the tools and techniques that can expedite payments while creating a seamless and professional payment experience for your clients.

What to Look for Legal Billing Invoicing Software

Depending on your firm’s size, location and area of legal expertise, your firm may need different types of legal practice management software tools than another firm.

But when it comes to sending client invoices and collecting payments, most firms know they need a dedicated legal billing software system to make this happen in a way that client invoices are accurate and client accounts are paid in a timely manner.

Let’s look at the 8 ways the right legal billing software helps make that happen.

1. Online Payment Options

Say goodbye to traditional payment methods!

With the integration of online payment options in legal billing software, your law firm can now offer clients the convenience of paying directly through your website or client portal.

Being able to make online payments (whether through credit card payments or a link to their checking account) will eliminate – or at least greatly reduce – the need for your clients to write manual checks and either send them by mail or have to come to your office in person.

Legal billing software that supports online payments is not only more convenient for your staff and your clients, but it has proven to significantly reduce delayed payments.

With just a few clicks, a client can make a secure online payment on their client account, accelerating the payment process and improving your firm’s cash flow.

2. Automated Payment Reminders

Time is valuable, and chasing down clients for overdue payments can be time-consuming (not to mention potentially embarrassing) for your attorneys, your staff, and certainly for your clients.

Legal billing software often includes automated payment reminder features that send gentle reminders to clients who have outstanding invoices.

These automated reminders help clients stay on top of their payment responsibilities, leading to faster payments and reducing the time spent on collections.

If you have a client who has had difficulty paying their invoices on time, installing payment plans for overdue invoices can also be a great benefit to the client and to your cash flow management.

Legal billing software that gives you this option can also be a game-changer in your firm’s accounting department, since they’ll have a better idea as to when the money is going to come in.

And – it can certainly help out those valued clients who just need a bit more time to pay their invoices in full.

3. Real-Time Payment Tracking:

With legal billing software, you gain real-time visibility into payment statuses and any outstanding balances.

Real-time payment tracking is a critical feature offered by good legal billing software that empowers law firms with up-to-date insights into payment statuses and outstanding balances.

Gone are the days of uncertainty and guesswork when it comes to tracking payments, which could often lead to invoices going unpaid or for clients being asked to pay for a service or billable hours they had already paid for.

With real-time payment tracking, law firms can stay on top of their finances and make informed decisions to optimize cash flow.

But the real beauty of real-time payment tracking lies in its immediacy.

For a firm that has chosen a legal billing software system like LeanLaw as well as the widely used accounting software Quickbooks Online, real-time payment tracking is going to seem practically seamless.

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookAnd your client invoices are going to reflect that.

As soon as a client makes a payment or an invoice is marked as paid, the legal billing software updates the payment status in real time. This means that you can instantly see which invoices have been settled and which ones are still outstanding.

If a payment is overdue, the software can automatically generate payment reminders and notifications to gently prompt clients to settle their invoices. Timely reminders are often all it takes to nudge clients into action, resulting in faster payment processing.

This level of transparency allows you to take prompt action when necessary, such as following up with clients on overdue payments or resolving any payment discrepancies quickly.

4. Customizable Invoices

Personalization goes a long way in enhancing the payment experience for clients.

Certain types of legal billing software (like LeanLaw) will allow you to customize your invoices and do things such as adding a client’s name, your firm’s logo, contact information, and relevant billing details.

Personalization is a powerful tool that can significantly enhance the payment experience for clients.

LeanLaw legal billing software offers a range of customization options that allow you to tailor your invoices to reflect your firm’s brand and professionalism.

By incorporating your firm’s logo and contact information into the invoice design, you create a sense of consistency and reinforce your firm’s identity with every invoice sent.

Beyond branding, the right legal billing software will also allow you to personalize billing details to match each client’s preferences and requirements.

This level of customization can include adding specific payment terms, and/or any other relevant billing information that is essential for your clients to understand the charges clearly. For instance, you can give descriptions of and itemize the expenses you’ve incurred, thus providing clients with a transparent view of any incurred costs, reinforcing the trust between your firm and the client.

Whether you bill hourly, offer flat fees, or have a combination of billing methods, the software allows you to configure your invoices accordingly, eliminating confusion and ensuring that clients receive accurate and well-organized invoices.

A well-designed invoice can instill confidence in your clients and make them more inclined to pay promptly.

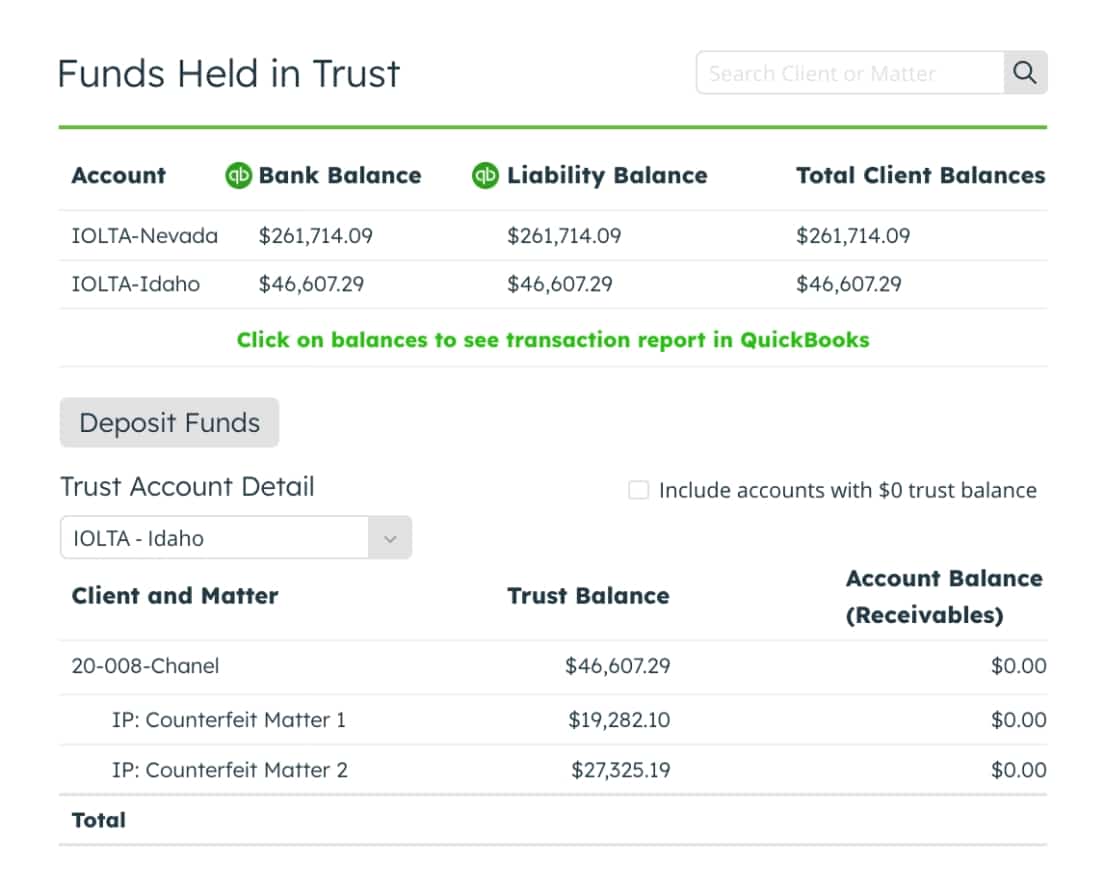

5. Trust Accounting Compliance

For law firms that manage trust accounts, legal billing software with integrated trust accounting compliance features is not just helpful, but it is essential to ensure compliance with strict accounting regulations.

A lawyer trust account holds the client funds that have been entrusted to lawyers for specific legal matters. These funds must be carefully managed and tracked to meet ethical and legal obligations.

One crucial feature of good legal billing software is the ability to create and manage separate trust accounts for each client, as well as track and record any activity in those accounts on client invoices.

By maintaining separate accounts, law firms can easily track and report on the funds held in trust for each client, simplifying the trust reconciliation process and ensuring transparency when reporting the balances and any withdrawals from each account.

Legal billing software should also enable law firms to accept retainers from clients and automatically apply these funds to future invoices as services are rendered.

This ensures that trust account funds are used only for their intended purposes and avoids potential misallocation or confusion.

Strong trust accounting features in your legal billing software will help ensure that all trust-related transactions are accurately recorded on every client invoice, making it easier to manage client retainers and track trust balances. Trust accounting compliance is crucial for maintaining ethical financial practices and maintaining your client’s trust.

6. Time and Expense Tracking Integration

Every successful law firm is going to need legal billing software that integrates easily with time and expense tracking tools, which is the cornerstone for ensuring that all billable hours and expenses are accurately recorded in your invoices.

When time and expense tracking tools are seamlessly integrated with a firm’s legal billing software, all billable activities are automatically captured and recorded in real time.

This automation eliminates the need for manual data entry, reducing the risk of errors and ensuring that no billable hours or expenses are missed.

This integration also enables legal practices to apply the appropriate billing rates to each task, ensuring clients are billed based on their fee arrangements.

These fees can include things like hourly rates, flat fees, contingency fees, or other billing amounts that you and your client have agreed on.

The system also allows for easy inclusion of expense details, such as travel expenses, court fees, and other disbursements, which ensures clients know exactly what they were charged for.

By producing accurate and detailed invoices efficiently, law firms can maintain a professional image, avoid billing disputes, get paid faster, and improve cash flow. The integration not only benefits the law firm’s internal processes but also enhances client satisfaction by providing clear and transparent billing information.

7. Mobile Accessibility

In today’s modern landscape, the best legal billing software will be just as easy for you and your client to use on your mobile devices as it is to use on your desktops.

Modern legal billing software should always come with mobile apps, allowing you and your clients to access billing information on the go.

Mobile accessibility enables you to respond promptly to client inquiries and review invoice statuses anytime, anywhere, promoting a smoother payment process.

Schedule a demo

Having mobile accessibility also means that your clients will be able to pay their invoices more quickly and not have to wait until they are sitting at a desk to do so.

They will be able to look at their itemized invoices, make payments, and quickly communicate with your firm about their accounts from anywhere they need to do so.

When looking for the right billing and accounting software for your firm, make sure not to overlook one that has a strong mobile app as well.

Mobile access to invoices and accounts can make a significant difference in how quickly your firm’s invoices get paid.

Legal Invoicing and Law Firm Billing Software: Find Out What’s Right For You

If you are looking for ways to increase how quickly your firm’s invoices get paid, look no further than LeanLaw, the best legal billing software on the market today.

Legal billing software serves as a powerful tool to streamline your billing process and get paid faster.

From online payment options, automated reminders, real-time payment tracking, and customizable invoices, LeanLaw can make the entire billing experience much easier and more effective for both you and your clients.

Trust accounting compliance, reporting and analytics, and time and expense tracking integration further enhance LeanLaw’s billing efficiency, enabling you to get paid faster and maintain a healthy cash flow.

Don’t let inaccurate invoices or delayed payments hinder your firm’s growth.

Instead, leverage the capabilities of LeanLaw’s billing and accounting software to expedite payments, ensure prompt collections, and take your entire legal billing process to new heights of financial success.

By harnessing the power of LeanLaw’s advanced and customized-for-law firm’s technology, you can guarantee your firm’s financial success, while also ensuring a positive and efficient payment experience for your clients.

If you’re ready to make the switch to the best legal billing software that’s available, come see what LeanLaw has waiting for you!