Operating a law firm is not for the faint of heart.

From keeping track of schedules to keeping track of finances, there is an endless list of tasks that must get accomplished and a limited amount of time to do them.

One of the largest challenges for any law firm is managing the various accounting needs, particularly when it comes to client funds.

As most attorneys require their clients to provide them with a retainer fee, making sure that those dollars are accounted for can become complicated if not done accurately from the moment they are received.

And, since there are some very specific rules around how client funds can be handled, it becomes even more imperative that a law firm has the right system of checks and balances in place to ensure that all funds are being managed appropriately and accounted for with complete transparency and accuracy.

What Are Client Funds and How are They Managed?

For most law firms, it is customary practice to ask a new client for a legal retainer before any attorney hours are billed on that client’s behalf.

A retainer is usually a set amount of money that the law firm collects from the client for work that will be done at a later date. A retainer may be for a particular matter or general services over a period of time.

When a firm collects a retainer from a client, those funds must be carefully managed and not confused with any operating funds for the law firm.

Often, if a client has been asked to provide the law firm with a large retainer, that client’s money may very well be held in a separate trust account that is specifically established for that client.

These types of accounts are usually opened at a reputable banking institution for clients who may have a particularly large case or when a law firm may provide legal services to that client on an ongoing basis.

But, for client retainers that are not substantial enough to warrant their own bank account, a firm will be required to place those client funds into an IOLTA account, where the funds will be held with the retainers of other clients as well.

What is an IOLTA Account?

The term IOLTA stands for Interest on Lawyers Trust Accounts.

First established in 1981, IOLTA accounts were created so that law firms could hold client funds collectively in an interest bearing trust account until the time those funds were needed.

Prior to 1981, commercial banks were prohibited by federal law from being able to pay interest on these types of deposits.

But thanks to the IOLTA program, it became legal in the early 80s for lawyers to place client funds into bank accounts that earn interest.

What Happens to the Interest Earned on an IOLTA Account?

When a firm deposits a client’s money into an IOLTA account, the interest earned on those dollars are then transferred to that state’s IOLTA programs. Make sure you understand the specifics of your state’s regulations on IOLTA accounts. Starting an IOLTA account in New Jersey may have very different requirements than IOLTA account Texas regulations.

Most IOLTA programs are run by the state’s bar association. The interest earned on IOLTA accounts is then used to provide civil legal services throughout that specific state.

From providing legal aid for underserved residents to providing scholarships for low-income students, the interest earned through IOLTA accounts goes a long way in helping each state find ways to serve certain populations that need it the most.

How is Interest Earned in an IOLTA Account Transferred?

One vitally important part of the IOLTA process is making sure that the interest on lawyers trust accounts is properly transferred and accounted for.

Though the IOLTA regulations will vary from state to state it’s imperative that a law firm become familiar with the timeline for transferring money from their IOLTA account into their state’s IOLTA program.

Penalties for the mismanagement of money held in an IOLTA trust account can be severe, and may even include disbarment if not handled correctly.

Once you establish your firm’s IOLTA account with a banking institution that is familiar with IOLTA lawyer trust accounts, you will need to familiarize yourself with the timeline and process for transferring interest earned funds in the appropriate way.

You’ll also need to make sure that you accurately account for those funds as well.

Again, failure to complete any one of these steps can result in serious consequences for you and your firm.

A Checklist for Properly Managing Your IOLTA Accounts

Though IOLTA accounts serve a great purpose in helping guarantee civil legal services for those who need them, they can be intimidating for many law firms to manage.

Making sure you know your state’s specific rules governing IOLTA accounts will be important, but below is a checklist of some best practices to put into place regarding your firm’s IOLTA account:

- Make sure that your firm’s operating funds and client funds are always kept separate.

- Educate yourself on the benefits of three-way reconciliation software in order to be able to sync your various accounts and create real-time accounting between your individual client accounts, your law firm’s account ledger, and your bank account’s monthly statements.

- Reconcile IOLTA accounts (using three-way reconciliation) at least once a month and more frequently if possible.

- Deposit all incoming retainer checks immediately into the appropriate trust accounts.

- Move earned fees out of your IOLTA account in a timely manner, or as specified by your state’s IOLTA program.

- Keep accurate and up-to-date records of all IOLTA funds, trust accounts, and any other interest bearing accounts your firm has. Err on the side of over-accounting for all trust funds, no matter how big or small.

Some of the most time-consuming work that a law firm’s accounting department must do is to stay accurate and up-to-date on the reconciliation of various accounts.

But even when a firm is painstakingly aware of the importance of accuracy, simple errors can happen that can put the whole firm in jeopardy.

But even when a firm is painstakingly aware of the importance of accuracy, simple errors can happen that can put the whole firm in jeopardy.

Avoiding these common errors is going to require a firm’s time and attention — both of which are precious commodities in a lawyer’s life.

Let LeanLaw Help You With All Your IOLTA Account Needs

For a firm that wants to maximize its time doing things other than accounting, there are excellent software programs that can automate many of the time-consuming, manual tasks of the past.

LeanLaw is designed to help law firms streamline their accounting needs while also teaching them the tools to be able to effectively and confidently manage all aspects of a firm’s operating needs.

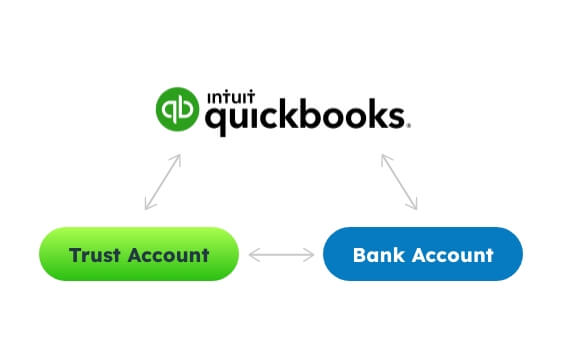

By using QuickBooks and a three-way reconciliation platform, LeanLaw is able to provide your firm with trust accounting software that will allow you to not only stay in compliance with industry standards but will also ensure that you are meeting state bar rules and regulations when handling IOLTA trust accounts and any other form of client trust fund accounts.

From tracking your firm’s IOLTA funds to tracking an attorney’s profits, LeanLaw is software that’s designed to give your accounting department the necessary control over your firm’s finances, while also making sure that it operates in a seamless and accurate way.

If you’d like to learn more about how LeanLaw can help your firm, reach out and request a free demo today!