Setting up an IOLTA trust account for your law firm is not difficult, but you’ll certainly want to make sure you follow certain guidelines along the way.

As with any financial account, having the appropriate documentation and abiding by all state and federal rules and regulations is incredibly important, especially because of the nature of an IOLTA account and the laws that govern them.

Understanding the Purpose of an IOLTA Account

First, let’s define exactly what an IOLTA account is, and the purpose it serves for your law firm and your client funds.

IOLTA stands for Interest on Lawyer Trust Accounts. These are bank checking accounts that law firms open with a financial institution where they can place client funds and earn interest at the same time.

For larger clients, a law firm may elect to open an interest bearing trust account for each individual client, if they are planning to hold larger sums of those client funds for longer periods of time.

But for short term client funds – when, for example, a law firm is only collecting a retainer for one specific case – opening one account and placing multiple clients’ money in that account is common.

An account that holds multiple clients’ funds (or retainers) is what is referred to as an IOLTA account.

These types of accounts then are allowed to earn interest.

And – since a law firm is not allowed to use that interest for their personal benefit or operating expenses – most states have set up IOLTA programs where that earned interest can be transferred to.

Schedule a demo

Interest earned on IOLTA accounts is then used to help fund various state programs, such as helping pay for civil legal services for those who can’t afford to retain legal services of their own, grants and scholarships for underprivileged individuals in the community, and other programs as needed.

Most state IOLTA programs are executed by the state bar association and have stringent laws surrounding them as to how the interest earned on these trust accounts can be used, and how it needs to be accounted for.

Setting Up Your Firm’s IOLTA Trust Account

Again – though these client trust accounts are not necessarily difficult to set up or maintain – you will want to ensure that you follow specific guidelines to guarantee that any funds belonging to your clients are accounted for accordingly.

First, Find the Right Financial Institution

Finding a financial institution that is approved to offer lawyer trust accounts to a firm should not be hard, since there are hundreds that are capable of offering this service in every state.

Most firms will start with the banking institution that currently holds any of their other accounts – such as their business account, personal account, or other trust accounts they already have established in order to hold larger client funds.

Any bank that is familiar with IOLTA accounts will understand the importance of establishing these client trust accounts appropriately, and the implications if they are not managed according to federal banking laws

Most will also be willing to pay premium interest rates on an IOLTA trust account because they are aware that the interest earned will be used for civil legal services within their state.

Second, Fill Out the Necessary Documents

Once you’ve decided on the best banking institution for your firm’s IOLTA trust account, the branch manager will give you the necessary paperwork to open the account. States may have different requirements for paperwork so make sure if you’re based in New Jersey you’re filling out the IOLTA NJ required forms.

It is imperative that you make sure that your IOLTA lawyer trust account has a separate account number from any other interest bearing account that you may have at that bank.

You will also want to ensure that your IOLTA lawyer trust account has a separate federal tax ID number than any of your other accounts as well.

Failure to separate any interest on lawyer trust accounts can end up having dire consequences for your firm, even if your actions weren’t intentional.

State and federal laws are strict around the management and use of the interest generated from IOLTA lawyers trust accounts, so you’ll want to make sure that these funds are being handled appropriately.

Get Help with Your Firm’s IOLTA Account Management

For any law firm that would like help with the management and oversight of their IOLTA accounts, LeanLaw has everything necessary to ensure that these accounts are being handled according to the laws surrounding them.

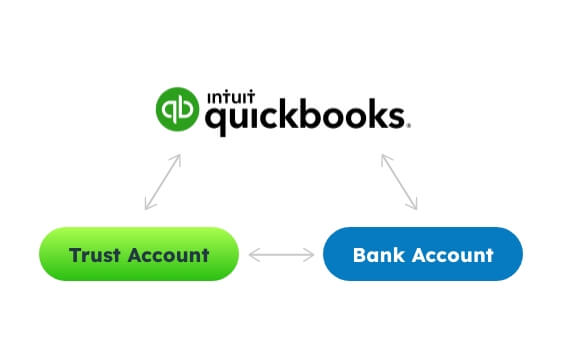

Our unique, three-way reconciliation process will make keeping track of net interest earned on all of your accounts an easy undertaking.

It will also confirm for you and your clients that any money being held by your firm is being managed professionally and appropriately.

LeanLaw’s legal software can also help you create accurate invoices, track profitability, run compensation reports, and more.

Being a good steward of client funds is a high priority for any good law firm. And being able to streamline the process is a plus for your firm’s bottom line.

Let LeanLaw help make that process as effortless as possible!