Any law practice that is in the practice of collecting retainer fees from clients may be wondering if there are certain rules and regulations around how to manage those funds until the time a client’s services are rendered.

The quick answer to this question is yes. Retainer fees that are collected from clients need to be carefully managed by a firm and there can be big consequences if they are not handled properly.

But how do you know if this is being done properly?

On top of everything else that needs to be accounted for in your firm, how do you make sure you aren’t misusing or mismanaging money that is not yet yours?

This is where IOLTA accounts come into play.

What is an IOLTA Account?

IOLTA accounts were set up and established to ensure that any client funds are kept separate from other funds in a law firm’s business accounts.

A client’s retainer should never be mixed with a law firm’s operating account until a service has been billed for and it’s clear that the legal services provided are now due compensation.

For a law firm that has a number of large clients who tend to use them frequently, these retainers can (and should!) be held in what’s called lawyer trust accounts.

Lawyer trust accounts are able to be set up separately from any other operating accounts that your firm may have, and any interest earned on these accounts can easily be credited back to the client, since it is clear that the client is the only one benefiting from these specific lawyer trust accounts.

But things can be quite different when a smaller client has provided a retainer for future services, but their situation is not one that warrants setting up a completely separate trust account for their case.

This is the perfect example of when an IOLTA account should be established by your firm to cover these types of situations.

Schedule a demo

An IOLTA account will give you a place to deposit and safeguard client funds until they are needed, without having to a) open a separate account for these funds or b) worry about enmeshing them with your law firm’s operating accounts in any way.

Remember – there are large fines and big consequences that can result from depositing client funds into your firm’s regular operating accounts.

What Happens with Interest Earned on an IOLTA Account?

An IOLTA bank account is not very different than a regular financial account.

These accounts are going to be considered an interest bearing trust account and will have interest generated just like any other bank account would.

But here is the possible problem…any lawyers trust accounts that are used to pool and then hold smaller retainers and then gain a net interest must comply with rules and regulations that are set up by each state for these types of client trust accounts.

Because no law firm is going to try and figure out which retainers earned which amount of interest, each of our 50 states have set up IOLTA programs to help decide what to do with these dollars earned from these accounts that bear interest for a firm.

Known as IOLTA programs, the dollars that are generated from client funds held in an interest bearing trust account are used for different purposes in each state, depending on the laws surrounding that state’s program.

Most IOLTA programs are managed and run by the state bar association.

It is common for the dollars held in the state’s IOLTA program to be used mainly for civil legal services, specifically for civil legal aid for people in that state that don’t have the means to pay for their own legal needs.

Some of the most common types of civil legal services that a state’s IOLTA program funds help pay for are things like assisting an individual who is dealing with an unwarranted eviction notice or helping a person who is financially challenged pay for law school.

How Do I Open and Establish an IOLTA Account?

Knowing that your law firm needs an IOLTA account is the first step to financial responsibility for your practice.

Learning how to set one up is the next one.

The best – and simplest – way to open and establish an IOLTA account is to speak with your firm’s current financial institution.

Many banks already have an IOLTA account program in place. They understand the process for establishing one, and what sort of reporting will need to be done to keep the bank and your firm in compliance with your state’s IOLTA program.

Your financial institution should have all the necessary paperwork ready for you to fill out. They will also be able to talk to you about what sort of requirements will be necessary from you, and what responsibilities they will be able to tackle in order to keep your IOLTA account in compliance with your state’s rules and regulations.

Where Else Can I Turn for Help?

For some firms, it may be much more realistic to turn to the experts for help when setting up an IOLTA trust account and making sure that all requirements are met, based on your state’s needs.

Schedule a demo

LeanLaw is a proven legal accounting software that can make the whole process of setting up an IOLTA trust account something that doesn’t require tons of hours on your side.

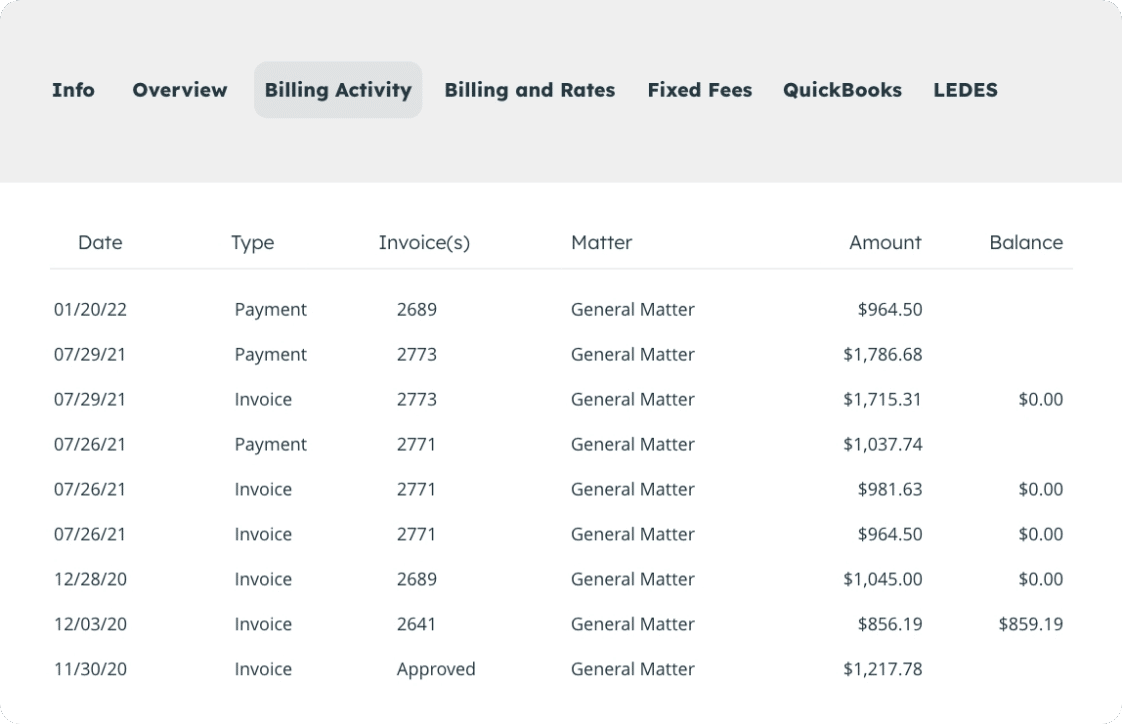

Thanks to our three-way reconciliation, your bank accounts, trust accounts and QuickBooks Online will not only be in constant sync with one another, but also in line with state bar standards.

You’ll never again have to worry about an account being out of balance, or money being allocated to an account when it shouldn’t have been.

Want to find out if LeanLaw can help your law firm move forward in the world of billing, accounting and accountability?

Reach out to us today!